NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE U.S.A

Vancouver, B.C., June 8, 2007 - Panoro Minerals Ltd. is pleased to announce that it has completed the purchase of 100% of the outstanding shares of Cordillera de las Minas S.A. ("CDLM"), a Peruvian corporation, from CVRD International S.A. ("CVRD") and El Tesoro (SPV Bermuda) Limited ("El Tesoro"), a wholly owned subsidiary of Antafagasta PLC.

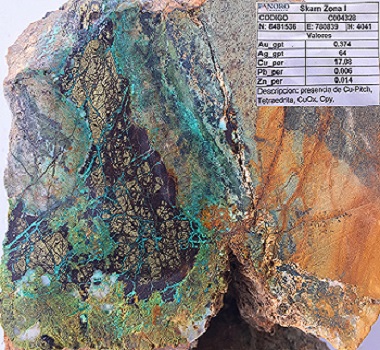

CDLM is the 100-per-cent owner of a portfolio of 13 properties, including the advanced stage Cotabambas and Antilla projects, all of which are located in the Andahuaylas Yauri belt of Peru south of Cuzco where a number of recently discovered significant porphyry copper and copper-gold deposits are in various stages of advanced exploration or predevelopment.

The acquisition was made pursuant to a purchase and sale agreement dated March 2, 2007 between the Company, CVRD and El Tesoro. The total purchase price for CDLM was US$13,000,000, US$500,000 of which was paid on signing of the agreement and the balance of US$12,500,000 was paid on closing. In addition, the Company issued 6,000,000 common shares to El Tesoro. These shares are subject to a hold period expiring on October 8, 2007.

In conjunction with the completion of the acquisition of CDLM, the 33,616,865 Subscription Receipts issued by the Company pursuant to the recently completed brokered private placement have been converted into 33,616,865 common shares and 16,808,432 share purchase warrants. Each share purchase warrant entitles the holder to acquire one common share at a price of $0.75 per share for a period of two years. These shares and warrants are subject to a statutory hold period expiring on September 25, 2007 (in respect of 32,204,434 of the shares and 16,102,217 of the warrants) and on September 30, 2007 (in respect of 1,412,431 of the shares and 706,215 of the warrants).

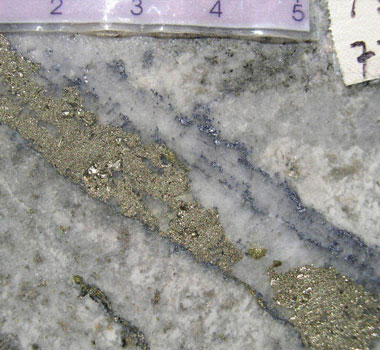

As reported in its May 30, 2007 news release, Panoro intends to embark on significant drilling programs on the core projects of the CDLM portfolio. Subject to permitting and the availability of drill rigs from reputable contractors, priority will be given to the Antilla project. The Antilla project features a geological potential in the order of 135 million tonnes of secondarily enriched sulphide mineralization defined by seven drill holes with a grade in the range between 0.63 per cent and 0.79 per cent copper, located near surface with a potentially very low waste to ore ratio. Panoro is adequately funded with approximately $7 million cash after completing the acquisition of CDLM.

On behalf of the Board of

Panoro Minerals Ltd.

William J. Boden

Director

ABOUT PANORO

Panoro Minerals Ltd. is a Canadian mineral exploration company trading on the TSX VENTURE:PML, FRANKFURT:PZM; (WKN914959) and BOLSA DE VALORES DE LIMA S.A., the Lima Stock Exchange - Junior Board:PML. Panoro's strategic focus is on exploring for large-potential gold and copper/gold deposits in countries with the corresponding geological potential and where the right political and economic conditions are present.

For investor inquiries please call 604-684 4246, or send an e-mail to info@panoro.com or visit the company's website at www.panoro.com.

This release was prepared by management of the Company who takes full responsibility for its contents. The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.