Vancouver, BC, January 5, 2010 - Panoro Minerals Ltd. ("Panoro" or the "Company") (TSX-V: PML, Franfurt: PZM, Bolsa de Valores Lima Junior Board: PML) is pleased to announce that the non-brokered private placement announced on December 7, 2009 was completed on December 30, 2009. Pursuant to the closing, Panoro issued 3,114,000 units at a price of $0.20 per unit for gross proceeds of $622,800.

Each unit is comprised of one common share and one common share purchase warrant. Each warrant is exercisable at a price of $0.30 per common share until June 30, 2011. The hold period for all securities issued under this private placement will expire on May 1, 2010. The warrants will carry a forced conversion feature such that should the common shares of Panoro trade at or above $0.45 per share for ten consecutive trading days, the Company may notify warrant holders in writing that the warrants must be exercised within 30 calendar days of the notice -- subsequent to which any unexercised warrants will expire.

Insiders of the Company subscribed for 600,000 units of the private placement for gross proceeds of $120,000. The Company will pay $49,824 in finder's fees and issue 249,120 finder's units which will entitle the finders to purchase units of the Company on the same terms as offered under the financing.

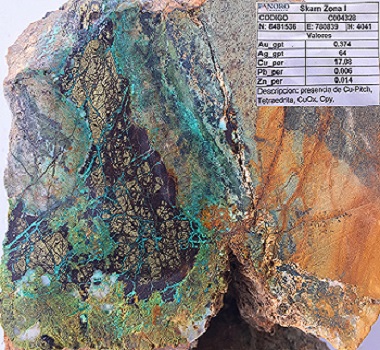

The proceeds of the financing will be utilized to advance the Company's exploration projects in Peru and for working capital purposes.

On behalf of the Board of

Panoro Minerals Ltd.

Luquman Shaheen, M.B.A, P.Eng., P.E.

President, CEO and Director

ABOUT PANORO Panoro's strategic focus is on exploring for large-potential gold and copper/gold deposits in countries with the corresponding geological potential and where the right political and economic conditions are present. For investor inquiries please call 604-684-4246, e-mail info@panoro.com or visit the company's website at www.panoro.com. This release was prepared by management of the Company which takes full responsibility for its contents.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.