Related Document

Vancouver, B.C., November 1, 2012 -- Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") Panoro is pleased to report additional assay results from its 100% owned Cotabambas porphyry copper-gold-silver project located in southern Peru. The drill results include exploration, step out and infill drill holes Highlights are as follows:

- 31.3 m intercept of supergene enriched oxide mineralization to the East of the existing resources grading 1.15% copper, 0.11 g/t gold and 2.3 g/t silver in hole CB-74, immediately underlain by a primary sulfide zone of 788.5 m grading 0.19% copper, 0.08 g/t gold and 3.1 g/t silver.

- 10.0 m intercept of supergene chalcocite mineralization enrichment grading 1.38% copper, 0.21 g/t gold and 1.8 g/t silver in hole CB-78, underlain by an extended primary zone of 598.7 m grading 0.13% copper, 0.06 g/t gold and 1.8 g/t silver.

- 78.0 m intercept of 0.73% Cu, 0.34 g/t Au and 4.3 g/t Ag primary mineralization in hole CB-75

The following table details the more significant intersections:

| Drillhole | From (m) | To (m) | Intercept (m) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) | Pb (%) | Zn (%) |

|---|---|---|---|---|---|---|---|---|---|

| CB-53 | no significant values | ||||||||

| CB-65 | 63.05 | 63.60 | 0.55 | 0.15 | 0.60 | 41.0 | 0.0010 | 2.38 | 3.50 |

| "" | 492.15 | 493.70 | 1.55 | 1.89 | 0.21 | 46.5 | 0.0010 | 8.82 | 15.55 |

| CB-67 | 0.00 | 28.00 | 28.00 | 0.25 | 0.06 | 0.5 | 0.0019 | n/a | n/a |

| "" | 28.00 | 93.80 | 65.80 | 0.14 | 0.04 | 1.2 | 0.0027 | n/a | n/a |

| "" | 152.75 | 179.00 | 26.25 | 0.21 | 0.04 | 1.3 | 0.0018 | n/a | n/a |

| "" | 179.00 | 203.10 | 24.10 | 0.18 | 0 | 0.6 | 0.0006 | n/a | n/a |

| CB-69 | 209.00 | 289.55 | 57.20 | 0.28 | 0.06 | 1.4 | 0.0013 | n/a | n/a |

| "" | 310.00 | 373.00 | 63.15 | 0.21 | 0.06 | 1.3 | 0.0013 | n/a | n/a |

| CB-73 | 0.00 | 7.70 | 5.70 | 0.37 | 0.07 | 0.9 | 0.0004 | n/a | n/a |

| "" | 7.70 | 58.40 | 50.80 | 0.10 | 0.48 | 2.1 | 0.0029 | n/a | n/a |

| "" | 58.40 | 120.40 | 62.00 | 0.83 | 0.01 | 0.6 | 0.0001 | n/a | n/a |

| "" | 145.10 | 233.70 | 88.60 | 0.25 | 0.13 | 2.0 | 0.0019 | n/a | n/a |

| "" | 258.80 | 414.70 | 156.00 | 0.12 | 0.06 | 2.1 | 0.0022 | n/a | n/a |

| CB-74 | 0.00 | 13.50 | 13.50 | 0.10 | 0.86 | 2.8 | 0.0010 | n/a | n/a |

| "" | 13.50 | 29.00 | 15.50 | 0.22 | 0.25 | 3.4 | 0.0014 | n/a | n/a |

| "" | 29.00 | 81.70 | 52.70 | 0.27 | 0.06 | 1.2 | 0.0006 | n/a | n/a |

| includes | 33.00 | 64.35 | 31.35 | 1.15 | 0.11 | 2.3 | 0.0010 | n/a | n/a |

| "" | 81.70 | 109.50 | 27.80 | 0.10 | 0.05 | 1.7 | 0.0010 | n/a | n/a |

| "" | 109.50 | 898.00 | 788.50 | 0.19 | 0.08 | 3.1 | 0.0054 | n/a | n/a |

| includes | 652.95 | 728.10 | 75.15 | 0.35 | 0.16 | 8.9 | 0.0019 | n/a | n/a |

| includes | 730.10 | 766.70 | 36.60 | 0.29 | 0.16 | 4.9 | 0.0049 | n/a | n/a |

| "" | 918.00 | 1004.00 | 86.00 | 0.20 | 0.04 | 1.8 | 0.0026 | n/a | n/a |

| CB-75 | 0.00 | 7.55 | 7.55 | 0.06 | 0.65 | 3.0 | 0.0028 | n/a | n/a |

| "" | 7.55 | 29.55 | 22.00 | 0.21 | 0.12 | 2.4 | 0.0020 | n/a | n/a |

| "" | 29.55 | 99.10 | 69.55 | 0.39 | 0.19 | 2.8 | 0.0019 | n/a | n/a |

| "" | 99.10 | 177.15 | 78.05 | 0.73 | 0.34 | 4.3 | 0.0028 | n/a | n/a |

| Includes | 99.10 | 101.10 | 2.00 | 4.57 | 0.28 | 7.0 | 0.0020 | n/a | n/a |

| Includes | 101.10 | 177.15 | 76.05 | 0.63 | 0.34 | 4.2 | 0.0028 | n/a | n/a |

| "" | 177.15 | 212.40 | 35.25 | 0.18 | 0.06 | 1.2 | 0.0020 | n/a | n/a |

| "" | 212.40 | 382.90 | 170.50 | 0.29 | 0.21 | 2.2 | 0.0021 | n/a | n/a |

| "" | 411.50 | 488.40 | 76.90 | 0.23 | 0.06 | 1.8 | 0.0047 | n/a | n/a |

| CB-78 | 1.10 | 21.80 | 20.70 | 0.62 | 0.48 | 3.1 | 0.0012 | n/a | n/a |

| "" | 21.80 | 77.80 | 56.00 | 0.10 | 0.46 | 1.8 | 0.0013 | n/a | n/a |

| "" | 77.80 | 97.80 | 20.00 | 0.64 | 0.12 | 1.0 | 0.0019 | n/a | n/a |

| "" | 97.80 | 121.80 | 24.00 | 0.08 | 0.13 | 1.2 | 0.0019 | n/a | n/a |

| "" | 121.80 | 131.80 | 10.00 | 1.38 | 0.21 | 1.8 | 0.0018 | n/a | n/a |

| "" | 131.80 | 730.55 | 598.75 | 0.13 | 0.06 | 1.8 | 0.0036 | n/a | n/a |

| includes | 131.80 | 217.20 | 85.40 | 0.29 | 0.11 | 2.1 | 0.0029 | n/a | n/a |

| includes | 475.45 | 501.90 | 26.45 | 0.52 | 0.48 | 6.7 | 0.0036 | n/a | n/a |

| includes | 460.90 | 473.70 | 12.80 | 0.28 | 0.21 | 3.6 | 0.0022 | n/a | n/a |

| includes | 527.10 | 577.00 | 49.90 | 0.31 | 0.12 | 4.3 | 0.0057 | n/a | n/a |

| includes | 619.15 | 654.55 | 35.40 | 0.16 | 0.04 | 2.4 | 0.0185 | n/a | n/a |

| CB-79 | 6.55 | 57.60 | 51.05 | 0.20 | 0.07 | 1.8 | 0.0011 | n/a | n/a |

| "" | 57.60 | 743.40 | 685.80 | 0.16 | 0.04 | 1.6 | 0.0085 | n/a | n/a |

| includes | 57.60 | 117.20 | 59.60 | 0.28 | 0.07 | 2.1 | 0.0015 | n/a | n/a |

| includes | 139.50 | 325.00 | 185.50 | 0.19 | 0.07 | 1.6 | 0.0021 | n/a | n/a |

| includes | 365.30 | 430.85 | 65.55 | 0.24 | 0.04 | 2.2 | 0.0090 | n/a | n/a |

| includes | 514.90 | 544.05 | 29.15 | 0.21 | 0.05 | 2.0 | 0.0207 | n/a | n/a |

| includes | 606.70 | 743.40 | 136.70 | 0.23 | 0.04 | 2.3 | 0.0272 | n/a | n/a |

Exploration Drill Holes

Hole CB-53 was an exploration hole collared 300 m to the southwest side of Ccalla Deposit to explore the potential for mineralization continuity associated with the Induced Polarization and Magnetic geophysical anomaly. It did not intersect significant values, potentially constraining the deposit in this area. Additional mapping in the area will be carried out to further understand the potential for mineralization to the southwest side of the Ccalla Deposit.

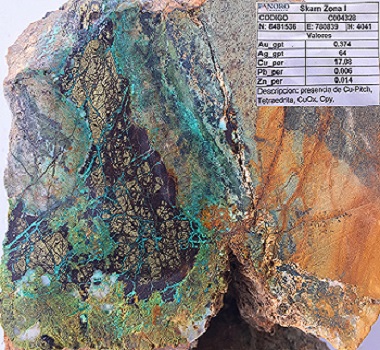

Hole CB-65 was an exploration hole drilled 200 m to the southwest side of Ccalla Deposit, to explore at depth the mineralized Porphyry outcroppings mapped in the area. It intercepted some anomalous values at depth of Cu, Ag and Mo as well as two narrow veins of low sulfidation epithermal polymetallic type mineralization. Both veins are located inside the pit shell limits used to confine the current mineral resource and expose high values in Ag, Pb and Zn.

Hole CB-69 was an exploratory hole drilled 200 m outside the west-southwest side of the Ccalla Deposit, to explore a possible change orientation of the mineralization. Two intervals of supergene and primary mineralization of 80.5 m and 63.1 m widths, respectively, were intersected both with Cu and Au mineralization located within the pit shell limits and above the cutoff grade of the current resource.

Step Out Drill Holes

Hole CB-67 was a step out hole drilled from near the western limit of the Ccalla Deposit. Intervals of mineralization associated with both supergene and primary mineralization were intersected above the cutoff grade, and contained within the pit shell limits, of the current resource.

Hole CB-74 was a step out hole drilled from the same site as previously

reported hole CB-46 but oriented in the opposite direction, to the East side of Ccalla Deposit. It is located parallel to, but 100 m south of, the previously reported hole CB-68 which has identified a new zone of primary mineralization to east of the Ccalla Deposit. From surface to 109.5 m depth various intervals of supergene copper mineralization were intersected, including from surface to 13.5 m of 0.10% Cu, 0.86 g/t Au and 2.8 g/t Ag, also intersected from 33.0 m to 64.3 m depth, 31.3 m of Cu oxide grading 1.15% Cu, 0.11 g/t Au and 2.3 g/t Ag. Immediately underlying the supergene zone is a primary sulfide zone of a total 788.5 m thickness grading on average 0.19% Cu, 0.08 g/t Au and 3.1 g/t Ag. The intersection of supergene mineralization indicates an attractive potential to delineate and expand the supergene zones to the east, and overlying, the new zone of primary mineralization.

Hole CB-79 is a step out hole to explore the east side of the Ccalla Deposit, within and below the pit shell limits of current resource. From surface, 51.0 m of oxides averaging 0.20% Cu, 0.07 g/t Au and 1.8 g/t Ag were intersected. The oxides are underlain by 685.8 m of primary mineralization grading on average 0.16 % Cu, 0.04 g/t Au and 1.6 g/t Ag, including various intervals with over 0.20% Cu. At depth, two intervals with attractive concentrations of Mo were also intersected and remain open at the bottom of the hole.

Infill Drill Holes

Hole CB-73 is an infill drill hole which intersected a near surface leached zone of 50.8 m thickness containing grades of 0.10% Cu, 0.48 g/t Au and 2.1 g/t Ag. This zone is underlain by a 62.0 m thick zone of oxide mineralization grading 0.83% Cu, 0.01 g/t Au and 0.60 g/t Ag. This zone was immediately underlain by an 88.6 m thick interval of primary sulfide mineralization grading 0.25% Cu, 0.13 g/t Au and 2.0 g/t Ag. Other intervals at depth intersected mineralization where additional exploration is needed.

Hole CB-75 is an infill drill hole which intersected 69.5 m of Cu oxide averaging 0.39 % Cu, 0.19 g/t Au and 2.8 g/t Ag, underlain by 78.0 m of primary sulfides grading 0.73 % Cu, 0.34 g/t Au and 4.3 g/t Ag. Additional zones of mineralization both above and below these two zones were intersected above the cutoff grades of the current resource.

Hole CB-78 is an infill hole that intersected from surface to 121.8 m depth, two horizons of Cu oxides interlaminated with others of Au oxides. The Cu oxide zones grade between 0.62% to 0.64% Cu, 0.12 to 0.48 g/t Au and 1.0 to 3.1 g/t Ag. The Au oxide zone has a thickness of 56.0 m and grades 0.10% Cu, 0.48 g/t Au and 1.8 g/t Ag. These zones are immediately underlain by 10.0 m of enriched calcosite grading 1.38% Cu, 0.21 g/t Au and 1.8 g/t Ag. At depth this hole intersected 598.7 m of primary mineralization immediately under the supergene horizons described above averaging 0.13 % Cu, 0.06 g/t Au and 1.8 g/t Ag with intervals of up to 0.52% Cu, 0.48 g/t Au and 6.7 g/t Ag. The primary mineralization extends outside the current resource limits to the west.

A map showing the locations of the drill holes is available at Panoro's website, www.panoro.com.

Four drills continue working at the Cotabambas Project and are engaged in step-out, exploration and infill drilling targetting continued growth of the resource and upgrade to indicated and measured categories.

Panoro's President & CEO, Luquman Shaheen states, "We are pleased with the ongoing exploration program and its results. The infill program continues to intersect mineralization in the areas expected, the step-out program is also identifying the potential to push the resource limits with continued drilling. The area to the East of the Ccalla deposit continues to offer the potential to significantly increase the resource in the future and the intersection of the supergene enriched zones in the area look interesting. We are still looking for potential extensions of mineralized zones to the south and southwest of Ccalla with additional effort on mapping."

About Panoro

Panoro's strategic focus is to move its advanced stage projects to the feasibility and development stages and to explore its other projects. The Company owns the advanced Cotabambas Copper-Gold and Antilla Copper-Molybdenum Projects which include Inferred level resources of:

| Cotabambas: | 404.1 Mt @ 0.42% Cu, 0.23g/t Au and 2.84g/t Ag @ 0.2% Cueq cut-off (AMEC 2012) (in situ content of 3.75 billion lbs. Cu, 3.0 million oz. Au, 36.9 million oz. Ag) |

| Antilla: | 154 Mt @ 0.47% Cu and 0.009% Mo @ 0.25% Cu cut-off (AMEC, 2009) (in-situ content of 1.6 billion lbs. Cu and 30 million lbs. Mo) |

Panoro's significant portfolio of properties is located primarily in the south-eastern region of Peru. This region contains a number of important copper and copper/gold deposits including Xstrata's Las Bambas and Antapaccay Copper Projects and the Tintaya Copper Mine. In September 2010, Xstrata announced US$5.7 billion of investment to develop the Las Bambas and Antapaccay projects. The region also includes First Quantum Minerals' Haquira Copper Project, HudBay Minerals' Constancia Copper Project and Southern Copper's Los Chancas Copper Project.

Luis Vela, P.Geo., a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen, M.B.A., P.Eng., P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd.

Luquman Shaheen, President & CEO

Phone:604.684.4246

Fax: 604.684.4200

Email: info@panoro.com

Web: www.panoro.com

Renmark Financial Communications Inc.

Barbara Komorowski: bkomorowski@renmarkfinancial.com

Bettina Filippone: bfilippone@renmarkfinancial.com

Media - Lynn Butler: lbutler@renmarkfinancial.com

Tel.: (514) 939-3989 or (416) 644-2020

www.renmarkfinancial.com

This release was prepared by management of the Company who takes full responsibility for its contents. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.