Related Document

Vancouver, B.C., September 11, 2012 -- Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") Panoro is pleased to announce that it has received a mineral resource estimate for the Cotabambas Project from AMEC Peru S.A. ("AMEC").

Highlights

- Base Case Inferred mineral resource estimate of 404.1 Mt at 0.42% Cu, 0.23 g/t Au and 2.84 g/t Ag at a cut-off of 0.20 % CuEq within a Mineral Resource Pit Shell

- High Grade Pit Shell within the Mineral Resource Pit Shell containing 199.8 Mt of Inferred Mineral Resources at 0.54% Cu, 0.30 g/t Au and 3.19 g/t Ag at a cut-off of 0.40% CuEq

- Excellent preliminary metallurgical recoveries of 87% Cu, 62% Au and 60% Ag into a clean concentrate grading 27% Cu, 11.9 g/t Au and 152 g/t Ag

- Potential to significantly increase resource tonnage and maintain grade on the basis of strong porphyry mineralization east of the stated base-case mineral resource estimate area, and at least partially within the current conceptual pit shell

Mineral Resource Estimate

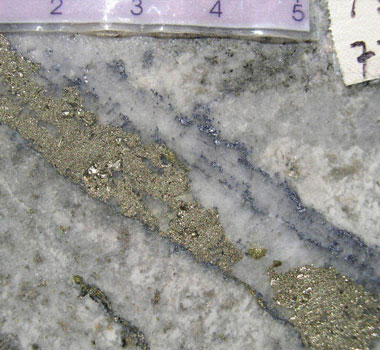

AMEC carried out a mineral resource estimate for the Cotabambas project having an effective date of 30 June, 2012 and based on 17,785 m of drilling by Panoro and 9,923 m of drilling from legacy campaigns. The mineral resource estimate consists of hypogene and supergene sulphides, and oxide copper and gold mineralization from the Ccalla and to a lesser extent the Azulccacca zones contained within a conceptual mineral resource pit shell. The Mineral Resource Pit Shell has been constructed to contain the portion of the mineral resource block model having reasonable prospects for economic extraction based on the current knowledge of the deposit. The mineral resource estimate for the deposit is summarized in Table 1:

| Inferred Mineral Resources | Cut-Off Grade | Million Metric Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Cu (B lbs) | Au (Moz) | Ag (Moz) |

|---|---|---|---|---|---|---|---|---|

| Hypogene Sulphide | 0.2 % CuEq | 381.8 | 0.40 | 0.24 | 2.94 | 3.32 | 2.9 | 36.1 |

| Supergene Sulphide | 0.2 % CuEq | 6.9 | 1.29 | 0.35 | 3.11 | 0.20 | 0.1 | 0.7 |

| Oxide Copper-Gold | 0.2 % Cu | 14.5 | 0.73 | - | - | 0.24 | - | - |

| Oxide Gold | 0.2 g/t Au | 0.8 | - | 0.88 | 3.95 | - | - | 0.1 |

| Total | 404.1 | 0.42 | 0.23 | 2.84 | 3.75 | 3.0 | 36.9 |

Note: Mineral Resources have an effective date of 30 June, 2012 and were estimated by Qualified Person Chris Wright, P.Geo. (APGO, 0901). The estimate is based on 17,785m of drilling by Panoro and 9,923m of drilling from legacy campaigns. Copper equivalent (CuEq) is calculated using the equation: CuEq = Cu + 0.4422 Au + 0.0065*Ag, based on the differentials of long range metal prices net of selling costs and metallurgical recoveries for gold and copper and silver. Mineralization would be mined from open pit and treated using conventional flotation and hydrometallurgical flow sheets. Rounding in accordance with reporting guidelines may result in summation differences.

These mineral resource estimates consist of Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is also no certainty that these Inferred Mineral Resources will be converted to the Measured and Indicated Mineral Resource categories through additional drilling.

Table 2 below presents a summary of the sensitivity of the mineral resources inside the Mineral Resource Pit Shell to select copper-equivalent cut-off grades.

Table 2: Sensitivity of Mineral Resource to Cut-off Grade

| Cut-Off Grade CuEq (%) | Million Metric Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Cu (B lbs) | Au (Moz) | Ag (Moz) |

|---|---|---|---|---|---|---|---|

| 0.2 | 404.1 | 0.42 | 0.23 | 2.84 | 3.75 | 3.0 | 36.9 |

| 0.3 | 345.9 | 0.46 | 0.27 | 3.10 | 3.50 | 3.0 | 34.5 |

| 0.4 | 265.9 | 0.52 | 0.30 | 3.33 | 3.02 | 2.6 | 28.5 |

| 0.5 | 187.0 | 0.59 | 0.34 | 3.62 | 2.43 | 2.1 | 21.8 |

| 0.6 | 123.4 | 0.68 | 0.39 | 3.96 | 1.84 | 1.6 | 15.7 |

Note: Base case cut-off grade is in bold. Inferred mineral resources are within the Mineral Resource Pit Shell.

High Grade Pit Shell

A High Grade Pit Shell was constructed to demonstrate the presence of a contiguous volume of higher grade mineralization within the base case Mineral Resource Pit Shell. The High Grade Pit Shell was constructed using the same criteria as the Mineral Resource Pit Shell and factoring base case metal prices by 0.55 to restrict the High Grade Pit Shell to higher grades within the deposit. Table 3 lists the portion of the Inferred Mineral Resources within the High Grade Pit Shell.

Table 3: Inferred Mineral Resources within the High Grade Pit Shell

| Inferred Mineral Resources | Cut-Off Grade | Tonnage (Mt) | Cu (%) | Au (g/t) | Ag (g/t) |

|---|---|---|---|---|---|

| Hypogene Sulphide | 0.4 % CuEq | 178.7 | 0.50 | 0.32 | 3.43 |

| Supergene Sulphide | 0.4 % CuEq | 6.6 | 1.33 | 0.37 | 3.16 |

| Oxide Copper-Gold | 0.4 % CuEq | 14.0 | 0.75 | - | - |

| Oxide Gold | 0.4 % CuEq | 0.6 | - | 1.07 | 4.56 |

| Total | 199.8 | 0.54 | 0.30 | 3.19 |

Note: Inferred Mineral Resources within the High Grade Pit Shell are included within the Inferred Mineral Resources in Table 1.

Exploration Potential

The Cotabambas Project has significant exploration potential. Drilling to the east of the Ccalla zone has encountered wide zones of porphyry copper-gold mineralization associated with previously undiscovered intrusives, including an intercept of 403.3 metres grading 0.47% copper, 0.16 g/t gold, 4 g/t silver and 0.009% molybdenum. These results were received after the database closure for AMEC's resource estimate and so this mineralization is not included in the current mineral resource estimate.

AMEC estimated an Exploration Target of 120 to 320 Mt with average grades of 0.50% CuEq to 0.60% CuEq for this new zone considering that this mineralization has been intersected in several drill holes in an area measuring 300 m wide, and 300 m long and is open to the north and at depth. Furthermore, the new zone is located partially within the current Mineral Resource Pit Shell and has the potential to allow access to deeper mineralization at the Ccalla deposit. AMEC also estimated an Exploration Target down-dip from the Ccalla deposit and below the floor of the current Mineral Resource pit shell offers an Exploration Target of an additional 100 Mt to 200 Mt with average grades of 0.4% to 0.5% CuEq considering that the zone has a length of approximately 1,000 m, a width of 200 m and is open at depth. Finally, considerable grass roots exploration potential exists on the 80% of the property that has not been explored to date.

AMEC cautions that the potential quantity and grade is conceptual in nature for the Exploration Targets, that there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the Exploration Targets being delineated as mineral resources.

Parameters and Assumptions Used in the Mineral Resource Estimate

The conceptual Mineral Resource and High Grade Pit Shells have been constructed according to technical and economic parameters in Table 4.

Table 4: Parameters Used in the Construction of the Mineral Resource and High Grade Pit Shells

| Parameter | Mineral Resource Pit Shell | High Grade Pit Shell | Units |

|---|---|---|---|

| Copper Price | 3.16 | 3.16 | US$/lb |

| Gold Price | 1,465 | 1,465 | US$/oz |

| Silver Price | 25.9 | 25.9 | US$/oz |

| Copper Selling Costs (SCu) | 0.03 | 0.03 | US$/lb |

| Gold Selling Costs (SAu) | 122 | 122 | US$/oz |

| Silver Selling Costs (Sag) | 5.85 | 5.85 | US$/oz |

| Copper Price net of Selling Costs (PCu) | 3.13 | 3.13 | US$/lb |

| Gold Price net of Selling Costs (PAu) | 1,343 | 1,343 | US$/oz |

| Silver Price net of Selling Costs (PAg) | 20.05 | 20.05 | US$/oz |

| Metal Price Factor | 1 | 0.55 | |

| Copper Recovery (Reccu) | 90.6 | 90.6 | % |

| Gold Recovery (RecAu) | 64 | 64 | % |

| Silver Recovery (RecAg) | 63 | 63 | % |

| Overall Pit Slope | 45 | 45 | degrees |

| Mining Cost | 1.75 | 1.75 | US$/tonne |

| Processing Cost | 7.25 | 7.25 | US$/tonne |

| General and Administration Cost | 1 | 1 | US$/tonne |

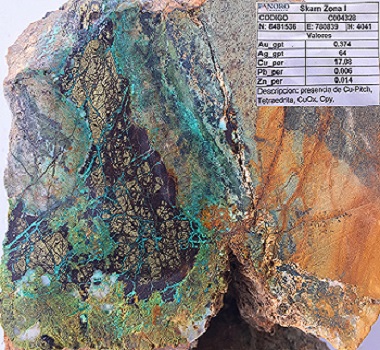

Metallurgical Testwork

Composites of drill core from the main mineralization types from the Ccalla and Azulccacca zones were subjected to preliminary metallurgical testing of leaching, flotation and comminution testwork. The metallurgical test work program was designed and supervised by AMEC and was performed by Certimin Peru, an ISO 9001 Certified Metallurgy Laboratory based in Lima, Peru. The test results are summarized in Table 5 below:

Table 5: Summary of Metallurgical Test Results

| Mineralization Type | Process | Recovery % | Concentrate Grade | ||||

|---|---|---|---|---|---|---|---|

| Cu (%) | Au (%) | Ag (%) | Cu (%) | Au (g/t) | Ag (g/t) | ||

| Hypogene Sulphide | Flotation | 87 | 62 | 60 | 27 | 11.9 | 152 |

| Supergene Sulphide | Flotation | 91 | 84 | 90 | 31.1 | 9.3 | 92.2 |

| Oxide Copper-Gold | Cyanide Leaching | - | 80 | 23 | - | - | - |

| H2SO4 Leaching | 70 | - | - | - | - | - | |

| Oxide Gold | Cyanide Leaching | - | 79 | 46 | - | - | - |

The preliminary comminution test work indicates that the Hypogene sulphide mineralization is of moderate hardness and the initial flotation test work indicates that it is possible to obtain a copper concentrate of commercial grade with reasonably high gold and silver grades. Based on results from these preliminary tests, the copper concentrates contain no significant levels of deleterious elements such as Sb, As, Bi, Pb and Zn that could incur smelter penalties. Both acid and cyanide leach recoveries likely may have the potential to be be improved for both the Oxide Copper-Gold and Oxide Gold mineralization types with further metallurgical testing.

Luquman Shaheen, President & CEO, states, "We are very pleased with this robust resource estimate which has exceeded our expectations. The total resource base for the Cotabambas project has increased by 245% for contained copper, by 256% for contained gold and now also includes 36.9 million ounces of silver. In addition to the large overall resource, there appears to be a higher grade zone contained within it that could ultimately be amenable to early mining for a positive impact on potential project economics. The metallurgical results demonstrate very good recoveries with no deleterious elements. Moreover, the exploration potential demonstrates that there is still significant resource potential to be realized with our on-going exploration programs. We look forward to completing up to 30,000 m of additional drilling at the Cotabambas Project and delivering more gains in the future."

Conference Call

The Company will be hosting a conference call to discuss the results of the Cotabambas Project resource estimate. The details for the conference call are presented below:

| Date: | Tuesday, September 11, 2012 | |

| Time: | 3:00 pm Eastern Time | |

| Dial in: | Local: 1-647-426-1845 International: +647-426-1845 North American Toll-Free: 1-866-782-8903 | |

| Replay: | Local: 1-416-915-1035 Toll-Free: 1-866-245-6755 | |

| Replay Passcode: | 2249013 |

The conference call replay will be available until midnight (Eastern Time), on September 25, 2012. An archived audio webcast of the call will also be available on Panoro's website.

About Panoro

Panoro's strategic focus is to move its advanced stage projects to the feasibility and development stages and to explore its other projects. The Company owns the advanced Cotabambas Copper-Gold and Antilla Copper-Molybdenum Projects which include Inferred category mineral resources* of:

| Cotabambas: | 404.1 Mt @ 0.42% Cu, 0.23g/t Au and 2.84g/t Ag @ 0.2% CuEq cut-off with an effective date of 30 June, 2012 (AMEC, 2012) (in situ content of 3.75 billion lbs. Cu, 3.0 million oz. Au, 36.9 million oz. Ag) | |

| Antilla: | 154 Mt @ 0.47% Cu and 0.009% Mo @ 0.25% Cu cut-off with an effective date of 1 June 2009, amended 23 August, 2009 (AMEC, 2009) (in-situ content of 1.6 billion lbs. Cu and 30 million lbs. Mo) |

*Note: Mineral Resources have reasonable prospects for economic exploitation from open pit considering conventional metallurgical process flow sheets. Key assumptions for the calculation of copper equivalent (CuEQ) for Cotabambas are provided in this press release. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is also no certainty that these Inferred mineral resources will be converted to the Measured and Indicated resource categories through additional drilling.

Panoro's significant portfolio of properties is located primarily in the south-eastern region of Peru. This region contains a number of important copper and copper/gold deposits including Xstrata's Las Bambas and Antapaccay Copper Projects and the Tintaya Copper Mine. In September 2010, Xstrata announced US$5.7 billion of investment to develop the Las Bambas and Antapaccay projects. The region also includes First Quantum Minerals' Haquira Copper Project, HudBay Minerals' Constancia Copper Project and Southern Copper's Los Chancas Copper Project.

Chris Staargaard, M.Sc., P.Geo., a Director of the Company and a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen, M.B.A., P.Eng., P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

| Panoro Minerals Ltd. Luquman Shaheen, President & CEO Phone:604.684.4246 Fax: 604.684.4200 Email: info@panoro.com Web: www.panoro.com | Renmark Financial Communications Inc. Barbara Komorowski: bkomorowski@renmarkfinancial.com Bettina Filippone: bfilippone@renmarkfinancial.com Media - Lynn Butler: lbutler@renmarkfinancial.com Tel.: (514) 939-3989 or (416) 644-2020 www.renmarkfinancial.com |

This release was prepared by management of the Company who takes full responsibility for its contents. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.