Vancouver, B.C., June 27, 2014 - Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") announces that it proposes to complete a non-brokered private placement (the "Private Placement") of 1,508,606 common shares (the "Shares") at a price of $0.42 per share with HudBay Minerals Inc. ("HudBay").

The private placement is being conducted in conjunction with the $5.0 million bought deal financing announced by the Company on June 23, 2014 (the "Bought Deal Offering"). Pursuant to a subscription agreement between the Company and HudBay dated June 30, 2011, HudBay was granted a pre-emptive right to purchase up to that number of Shares as will enable it, upon completion of the Bought Deal Offering, to maintain the same percentage interest in the Company after the completion of the Bought Deal Offering. HudBay currently holds 22,907,500 common shares of the Company representing approximately 11.2% of the issued common shares of the Company.

Furthermore, in the event the underwriters of the Bought Deal Offering exercise the full amount of their over-allotment option pursuant to the Bought Deal Offering, HudBay has agreed to exercise its pre-emptive right to purchase an additional 226,291 Shares on the same terms as the Private Placement.

The Company intends to use the net proceeds from the Offering to fund the continued exploration and development of the Company's Cotabambas Project, as well as for working capital and general corporate purposes.

The Shares acquired by HudBay will be subject to a hold period of four months plus one day from the date of closing of the Private Placement in accordance with applicable securities legislation.

The Private Placement is subject to the approval of the TSX Venture Exchange. It is anticipated that the Private Placement will be completed concurrently with or immediately following the completion of the Bought Deal Offering.

About Panoro

Panoro is advancing its significant portfolio of copper and gold projects in the key Andahuaylas-Yauri belt in south central Peru, including its advanced stage Cotabambas Copper-Gold-Silver-Molybdenum and Antilla Copper-Molybdenum Projects.

Since 2007, the company has completed over 70,000 m of exploration drilling at these two key projects leading to the delineation of mineral resources in late 2013 of:

| Cotabambas: | Indicated Resource 117.1 Mt @ 0.42% Cu, 0.23g/t Au, 2.74 g/t Ag & 0.001%Mo (@0.2% Cueq cutoff) Inferred Resource 605.3 Mt @ 0.31% Cu, 0.17g/t Au, 2.33 g/t Ag and 0.002 %Mo (@0.2% Cueq cutoff) (Tetra Tech, 2013). | |

| Antilla: | Indicated Resource 188.5 Mt @ 0.40% Cu and 0.009% Mo (@0.2% Cueq cutoff) Inferred Resource 145.9 Mt @ 0.28% Cu and 0.009%Mo (@0.2% Cueq cutoff) (Tetra Tech, 2014). | |

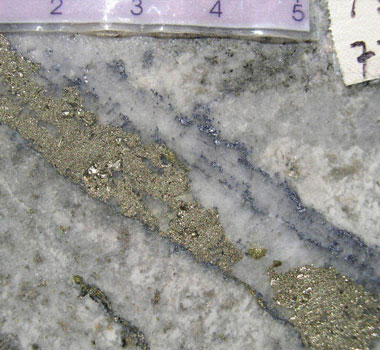

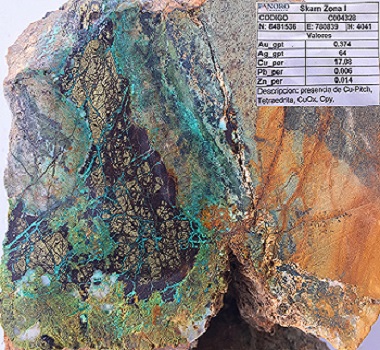

Panoro continues its exploration at the Cotabambas project while a Preliminary Economic Assessment (PEA) is underway by AMEC Americas Ltd. The PEA is due for completion in fall of 2014. The already significant resource, together with significant geologic potential demonstrate the potential for a large scale open pit mine at the project. To date exploration at the Cotabambas Project has focused on the Ccalla and Azulccaca deposits. However, at least eight other porphyry and skarn target zones have been identified on the property and drilling is planned.

A PEA for the Antilla Project is also planned for completion in fall of 2014. The moderate scale of the resource at the Antilla Project together with strong infrastructure in the area may result in a moderate capital cost development plan for the project.

In addition to the Cotabambas and Antilla Projects, Panoro's portfolio includes more than 10 earlier stage projects in the same region of south central Peru. Peru's national objective of doubling copper production together with the development of the many copper projects in the region, together with the private and public investments into rail, road, power generation and transmission and port infrastructure are leading to the rapid growth of an important global center for copper production. Panoro's large portfolio is situated here along with the Las Bambas, Tintaya, Antapaccay, Haquira, Constancia, Los Chancas and Trapiche projects, all of which are either in construction or already in production.

Luis Vela, a P. Geo Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman A. Shaheen, M.B.A., P.Eng., P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd.

Luquman A. Shaheen, President & CEO

Phone: 604.684.4246

Fax: 604.684.4200

Email: info@panoro.com

Web: www.panoro.com

Renmark Financial Communications Inc.

Barbara Komorowski:

bkomorowski@renmarkfinancial.com

Tel.: (514) 939-3989 or (416) 644-2020

www.renmarkfinancial.com

This release was prepared by management of the Company who takes full responsibility for its contents. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.