Related Document

Vancouver, B.C., December 12, 2018 – Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) (“Panoro”, the “Company”) is pleased to provide an update on exploration progress and plans for its flagship Cotabambas Copper/Gold/Silver Project.

Cotabambas Project

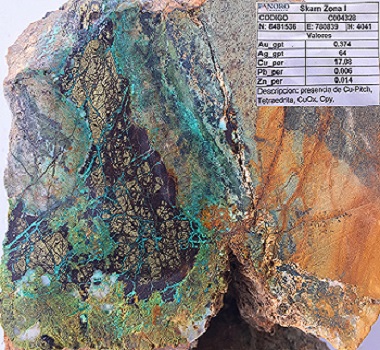

Panoro has completed the field work for the ground geophysical program at the Chaupec Target in Cluster 2 of the Cotabambas Project. In addition, the Company has identified two new targets of skarn/porphyry mineralization at Zone 4 and Tamburo, to the north and east of the Chaupec target, see attached map for reference.

Chaupec Target

The completed geophysical survey at the Chaupec Target covers an area of 500 by 1,000m, and includes:

- 3D Ground Magnetometry including 20 lines of 1km length each, at 25m spacing between lines and continuous readings.

- IP3D including 10 lines of 1 km length, spacing of 50m between lines and with stations of 25, 50, 75 & 100 meters multidipole with penetration to 500m depth.

- Gravity survey, pending completion in January 2019, with 110 points spaced 50 to 100m over the same grid as for the Magnetometry and IP.

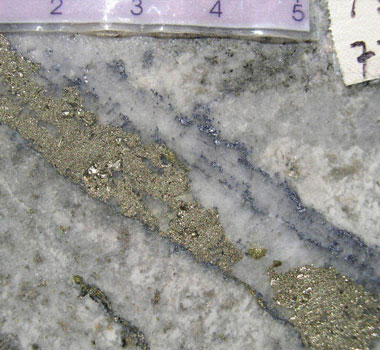

The geophysical program was completed at the northern area of Zone 1 at Chaupec, where the diorite overthrusts the limestones layers from east to west. Dikes and sills of quartzmonzonite porphyry intrude the contact generating skarn bodies up to 450m width. The vertical connection of the dikes/sills with the main porphyry stock is expected 200m to 300m below the surface, as is exposed in Zone 3 located 3km to the south (refer to August 28, 2018 press release. )

Interpretation of the geophysical results and integration with the geologic model is currently underway with the objective of completing the drill targetting for the proposed drill hole exploration program. The drill hole program will commence in January 2019.

Two New Targets

Two new targets representing the extension of the Cu, Ag, Au skarn mineralization in Chaupec, have been identified through mapping and sampling campaigns currently underway.

The new target Zone 4 represents the north continuity of Zone 1 in Chaupec, but displaced 900m to the west.

The second new target, Tamburo is located 900 to 2,000m to the east of Zone 1 in Chaupec, where the mapping; currently underway, has found three skarn areas. Tamburo is part of a 9km corridor in eastwest direction, containing six Porphyry/Skarn mineralized zones and target areas including the:

- Ccalla east Target;

- Ccalla Deposit;

- Petra/David Target;

- Guaclle Target;

- Tamburo Target; and

- Chaupec Target.

About Panoro

Panoro Minerals is a uniquely positioned Peru focused copper exploration and development company. The Company is advancing its two advanced stage copper projects;

- Cotabambas CopperGoldSilver Project; and

- Antilla CopperMolybdenum Project.

The Company also has two early stage projects being funded and/or advanced with partners;

- Kusiorcco Copper Project, funded by Hudbay Minerals; and

- Humamantata Copper Project, funded by JOGMEC.

All of Panoro’s Projects are located in the strategically important area of southern Peru. The region boasts the recent investment of over US$15 billion into the construction or expansion of four large open pit copper mines (Las Bambas, Constancia, Antapaccay and Cerro Verde) and another $US 6.5 billion being invested currently into two additional open pit copper mines (Mina Justa and Quelleveco).

Since 2007, the Company has completed over 80,000 meters of exploration drilling at these two key projects leading to substantial increases in the mineral resource base for each, as summarized in the table below.

Summary of Cotabambas and Antilla Project Resources

| Project | Resource Classification | Million Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

|---|---|---|---|---|---|---|

| Cotabambas Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 |

| Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | |

| @ 0.20% CuEq cutoff, effective October 2013, Tetratech | ||||||

| Antilla Cu/Mo | Indicated | 291.8 | 0.34 | 0.01 | ||

| Inferred | 90.5 | 0.26 | 0.007 | |||

| @ 0.175% CuEq cutoff, effective May 2016, Tetratech | ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

| Key Project Parameters | Cotabambas Cu/Au/Ag Project1 | Antilla Cu Project2 | ||

|---|---|---|---|---|

| Process Feed, life of mine | million tonnes | 483.1 | 118.7 | |

| Process Feed, daily | Tonnes | 80,000 | 20,000 | |

| Strip Ratio, life of mine | 1.25 : 1 | 1.38: 1 | ||

| Before Tax1 | NPV7.5% | million USD | 1,053 | 520 |

| IRR | % | 20.4 | 34.7 | |

| Payback | years | 3.2 | 2.6 | |

| After Tax1 | NPV7.5% | million USD | 684 | 305 |

| IRR | % | 16.7 | 25.9 | |

| Payback | years | 3.6 | 3.0 | |

| Annual Average Payable Metals | Cu | thousand tonnes | 70.5 | 21.0 |

| Au | thousand ounces | 95.1 | ||

| Ag | thousand ounces | 1,018.4 | ||

| Mo | thousand tonnes | |||

| Initial Capital Cost | million USD | 1,530 | 250 | |

| ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. PEng, PE, MBA

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd. | Renmark Financial Communications Inc. |

CAUTION REGARDING FORWARD LOOKING STATEMENTS: Information and statements contained in this news release that are not historical facts are “forwardlooking information” within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Forwardlooking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forwardlooking statements, including, without limitation:

- risks relating to metal price fluctuations;

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning or reclamation expenses, proving to be inaccurate;

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro’s control;

- risks relating to Panoro’s ability to enforce Panoro’s legal rights under permits or licenses or risk that Panoro’s will become subject to litigation or arbitration that has an adverse outcome;

- risks relating to Panoro’s projects being in Peru, including political, economic and regulatory instability;

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits;

- risks relating to potential challenges to Panoro’s right to explore and/or develop its projects;

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances;

- risks relating to Panoro’s operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict Panoro’s operations;

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law;

- risks relating to inadequate insurance or inability to obtain insurance;

- risks relating to the fact that Panoro’s properties are not yet in commercial production;

- risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates; and

- risks relating to Panoro’s ability to raise funding to continue its exploration, development and mining activities.

This list is not exhaustive of the factors that may affect the forwardlooking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward‑looking information. The forward‑looking information contained in this news release is based on beliefs, expectations and opinions as of the date of this news release. For the reasons set forth above, readers are cautioned not to place undue reliance on forwardlooking information. Panoro does not undertake to update any forwardlooking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.