Related Document

VANCOUVER, B.C., August 11, 2021 – Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM, OTCQB: POROF) ("Panoro" or the "Company") announces that it has agreed with its JV partner, Japan Oil, Gas and Metals National Corporation (JOGMEC), to terminate the interim Agreement for the joint venture of the Humamantata Project. The agreement was completed in 2018 providing for JOGMEC to earn up to a 60% project interest. Exploration at the project has identified four porphyry, hydrothermal breccia and skarn targets with anomalous grades of copper, silver and gold extending for more than 1.5 km along strike. Permitting completed at the project includes approval of the environmental permit, water permit and archeological permit. Access agreements with private land owners are also complete.

"We are pleased that Panoro and JOGMEC worked together to identify very prospective mineralized targets while substantially completing the permitting required to start drilling. Unfortunately, budget constraints and schedule delays, resulting from the Covid-19 pandemic, do not permit JOGMEC to continue funding the next phase of exploration. Approximately USD 2.4 million has been invested in the exploration work to date and we look forward to advancing the project in the near future.", stated Luquman Shaheen, President & CEO.

The Humamantata Project is strategically located in Southern Peru, in the vicinity of the Las Bambas Copper Mine (MMG), the Constancia Copper Mine (Hudbay) and other important copper projects such as Haquira (First Quantum), Antilla (Panoro) and Cotabambas (Panoro).

The Company retains a 100% interest in the Humamantata Project and will be assessing other joint venture or partnership agreements to continue advancing the exploration programs.

To date the Company has completed the following field activities:

- Geologic mapping at 1:1,000 scale over an area covering 1,200 hectares of the total 3,600 hectares of concessions comprising the Humamantata Project;

- 647 samples from surface outcrops have been collected over the target areas for geochemical analysis;

- 68 fresh and mineralized rock samples for Mineragraphy and Petrography studies;

- 130 fresh and mineralized rock samples for a Lithogeochemistry study;

- 496 rock samples by PIMA Spectrometry for a mineral alterations study;

- 53.2 km of ground Induced Polarization geophysical surveys; and

- 80 km of ground Magnetic Resonance surveys.

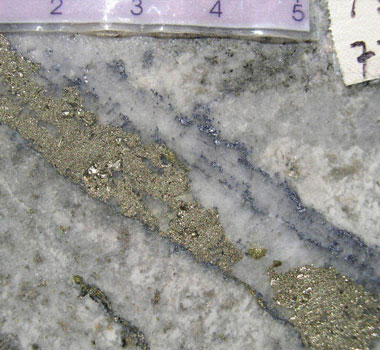

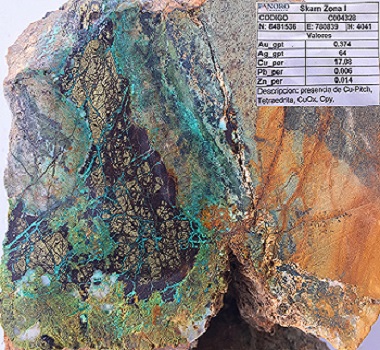

The exploration program has identify four targets:

- Target 1, Cu/Au/Ag porphyry mineralization located to the north of the property;

- With grades up to 2.69% Cu, 69.5 g/t Ag, 0.82 g/t Au, 374 ppm Mo

- Target 2, Ag Hydrothermal Breccia Mineralization located to the south of Target 1;

- With grades up to 332 g/t Ag, 0.42 g/t Au, 1,151 ppm Mo

- Target 3, Ag Hydrothermal Breccia and Ag-Cu Stockwork Mineralization in the south property; and

- With grades up to 0.57% Cu, 210 g/t Ag, 0.091 g/t Au, 240 ppm Mo

- Target 4. Ag Hydrothermal Breccia and Cu-Au Skarn Mineralization located to the north of Target 2.

- With grades up to 1.19% Cu, 501 g/t Ag, 0.12 g/t Au, 160 ppm Mo

About Panoro

Panoro is a uniquely positioned Peru focused copper exploration and development company. The Company is advancing its flagship project, Cotabambas Copper-Gold-Silver Project and its Antilla Copper-Molybdenum Projects located in the strategically important area of southern Peru.

Panoro has completed strategic partnerships at three of its projects:

- Wheaton Precious Metals - Precious Metals Purchase Agreement, Cotabambas Project;

- Hudbay Minerals – NSR Royalty and Cash sale, Kusiorcco Project; and

- Mintania – NSR Royalty and Cash sale, Cochasayhuas Project.

At the Cotabambas Project, the Company is focused on delineating the growth potential while optimizing the project economics. Exploration and step-out drilling from 2017, 2018 and 2019 have identified the potential for both oxide and sulphide resource growth.

Summary of Cotabambas and Antilla Project Resources

Project | Resource | Million | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) | CuEq % |

Cotabambas | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 | 0.59 |

Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | 0.44 | |

@ 0.20% CuEq cutoff, effective October 2013, Tetratech |

| ||||||

Antilla Cu/Mo | Indicated | 291.8 | 0.34 | - | - | 0.01 | 0.38 |

Inferred | 90.5 | 0.26 | - | - | 0.007 | 0.29 | |

@ 0.175% CuEq cutoff, effective May 2016, Tetratech |

| ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

Key Project Parameters |

| Cotabambas Cu/Au/Ag | Antilla Cu | |

Process Feed, life of mine | million tonnes | 483.1 | 118.7 | |

Process Feed, daily | Tonnes | 80,000 | 20,000 | |

Strip Ratio, life of mine |

| 1.25 : 1 | 1.38 : 1 | |

Before | NPV7.5% | million USD | 1,053 | 520 |

IRR | % | 20.4 | 34.7 | |

Payback | years | 3.2 | 2.6 | |

After | NPV7.5% | million USD | 684 | 305 |

IRR | % | 16.7 | 25.9 | |

Payback | years | 3.6 | 3.0 | |

Annual | Cu | thousand tonnes | 70.5 | 21.0 |

Au | thousand ounces | 95.1 | - | |

Ag | thousand ounces | 1,018.4 | - | |

Mo | thousand tonnes | - | - | |

Initial Capital Cost | million USD | 1,530 | 250 | |

| ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. M.B.A., P.Eng, P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd. | Renmark Financial Communications Inc. |

CAUTION REGARDING FORWARD LOOKING STATEMENTS: Information and statements contained in this news release that are not historical facts are "forward-looking information" within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Examples of forward-looking information and statements contained in this news release include information and statements with respect to:

- acceleration of payments by Wheaton Metals to match third party financing by Panoro targeted for exploration at the Cotabambas Project;

- payment by Wheaton Metals of US$140 million in installments;

- Panoro weathering the current depressed equity and commodity markets, minimizing dilution to existing shareholders and making targeted investments into exploration at the Cotabambas Project;

- mineral resource estimates and assumptions;

- the PEA, including, but not limited to, base case parameters and assumptions, forecasts of net present value, internal rate of return and payback; and

- copper concentrate grade from the Cotabambas Project.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. In some instances, material assumptions and factors are presented or discussed in this news release in connection with the statements or disclosure containing the forward-looking information and statements. You are cautioned that the following list of material factors and assumptions is not exhaustive. The factors and assumptions include, but are not limited to, assumptions concerning: metal prices and by-product credits; cut-off grades; short and long term power prices; processing recovery rates; mine plans and production scheduling; process and infrastructure design and implementation; accuracy of the estimation of operating and capital costs; applicable tax and royalty rates; open-pit design; accuracy of mineral reserve and resource estimates and reserve and resource modeling; reliability of sampling and assay data; representativeness of mineralization; accuracy of metallurgical test work; and amenability of upgrading and blending mineralization.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- risks relating to metal price fluctuations;

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning or reclamation expenses, proving to be inaccurate;

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro's control;

- risks relating to Panoro's ability to enforce Panoro's legal rights under permits or licenses or risk that Panoro's will become subject to litigation or arbitration that has an adverse outcome;

- risks relating to Panoro's projects being in Peru, including political, economic and regulatory instability;

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits;

- risks relating to potential challenges to Panoro's right to explore and/or develop its projects;

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances;

- risks relating to Panoro's operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict Panoro's operations;

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law;

- risks relating to inadequate insurance or inability to obtain insurance;

- risks relating to the fact that Panoro's properties are not yet in commercial production;

- risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates; and

- risks relating to Panoro's ability to raise funding to continue its exploration, development and mining activities.

This list is not exhaustive of the factors that may affect the forward-looking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information. The forwardlooking information contained in this news release is based on beliefs, expectations and opinions as of the date of this news release. For the reasons set forth above, readers are cautioned not to place undue reliance on forward-looking information. Panoro does not undertake to update any forward-looking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.