Related Document

VANCOUVER, B.C., June 7, 2022 – Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM, OTCQB: POROF) ("Panoro", the "Company") is pleased to provide an update of its exploration drill program at its 100% owned Cotabambas Cu/Au/Ag Project in Peru.

Drillhole CB-195, the first hole completed of the 2022 program, intersected 195.8m averaging 0.55% Cu, 0.52 Au g/t, 2.88 Ag g/t (0.92% Cueq), including a profile of copper oxides, mixed and hypogene zones. The primary copper sulfides in the hypogene zone include 45.7m grading 0.95% Cu, 0.78 g/t Au and 4.35 g/t Au (1.51% Cueq) into a porphyry stock of quartz monzonite composition.

The drill program commenced with the mobilization of the first drill rig during the last week of April 2022 at the South Pit area. The drill core was logged and sampled on site and samples were prepared and analyzed at ALS Chemex Laboratories in Lima.

The South Pit Area

The South Pit target is located between 400m to 1200m to the south of the proposed North Pit as defined by the September 22, 2015 Preliminary Economic Assessment. The Hole CB-195 tested the mineralized area located between previous Drillholes CB-23 and CB-34, see link 1, and was completed to a total depth of 240.2m. The following table details the more significant intersections.

Drillhole | From (m) | To (m) | Metres | Cu (%) | Au g/t | Ag g/t | Cueq1 (%) | Zone |

CB-195 | 35.0 | 230.8 | 195.8 | 0.55 | 0.52 | 2.88 | 0.92 | |

“ ” | 35.0 | 75.5 | 40.5 | 0.40 | 0.37 | 2.77 | 0.67 | Oxide |

“ ” | 75.5 | 95.0 | 19.5 | 1.01 | 1.15 | 5.18 | 1.83 | Mixed |

“ ” | 95.0 | 230.8 | 135.8 | 0.53 | 0.48 | 2.59 | 0.88 | Primary |

Include | 95.0 | 140.7 | 45.7 | 0.95 | 0.78 | 4.35 | 1.51 | Primary |

| ||||||||

Luquman Shaheen, President & CEO, of Panoro Minerals states, “The results of drillhole CB-195 validate Panoro’s thesis that there exists potential to grow the high-grade component of the Cotabambas Project resource. The high grades have been intersected near surface with the potential to provide additional high grade to the mine plan early in the proposed mine-life. Furthermore, the intersection of the high grades in CB-195 at the South Pit also indicate the potential to extend the high grade intersects along strike from the South Pit to the North Pit and to the north of the North Pit, see link 2. Step out and infill drilling is planned in these areas as part of the on-going exploration program. The exploration program will continue to the end of the year with an estimated 16,000 m of exploration drilling to be completed. We look forward to announcing results from drill hole assays as they are received and analyzed.”

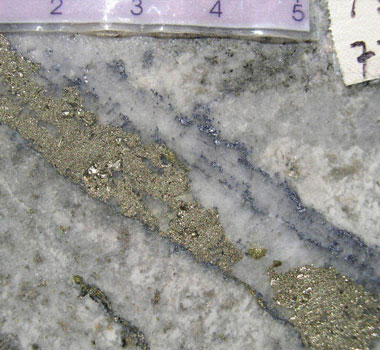

See link 3 for cross section at drill hole location. The hole commenced within a barren lithocap leach capping of volcanic andesite package and diorite intrusive from surface to 35 m, including supergene argillic alteration and traces of copper and manganese oxides.

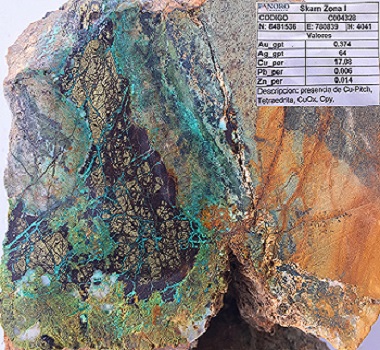

From 35.0m to 75.5m the hole intersected phyllic and potassically altered quartz monzonite with copper oxide grading 0.40% Cu, 0.37 g/t Au, 2.77 g/t Ag (0.67% Cueq). The copper oxides species are chrysocolla, malachite, tenorite, neotocite and iron oxides.

From 75.5m to 95.0 m the drill hole intersected potassic interleaved with sericite, chlorite, clay (SCC) alterations in the quartz monzonite porphyry hosting a copper mixed zone of 19.5m width averaging 1.01% Cu, 1.15 g/t Au, 5.18 g/t Ag (1.83% Cueq). The mineralogic species are a mix of chrysocolla, tenorite, neotocite, chalcopyrite and pyrite into a framework of quartz veinlets.

Finally, from 95.0m to 230.8m over the quartz monzonite porphyry with potassic/SCC alteration with primary chalcopyrite mineralization of 135.8m width grading 0.53% Cu, 0.48 g/t Au and 2.59 g/t Ag (0.88% Cueq), before re-entering the diorite intrusive host rock. A more strongly mineralized, silicified and potassically altered interval with disseminations and veinlets of chalcopyrite graded 0.95 % Cu, 0.78 g/t Au and 4.35 g/t Ag (1.51% Cueq) over 45.7 meters from 95.0 m to 140.7m.

Drilling has shown that the extensive chalcopyrite mineralization and potassic alteration in the porphyry “center” is surrounded by “proximal” SCC alteration with pyrite>chalcopyrite sulfides and “distal” propylic alteration with disseminated pyrite mineralization into the diorite host rock. The gold and silver values occur overall this lateral zoning and randomly emplaced with the SCC and potassic alteration event.

Most of the high grade intersected by this hole will represent new resources to be added in the block model of the 2015 PEA pit.

Additional drilling continues to test this mineralization to the northeast with the step out hole CB-196, which assays results are in progress and published in a next press release.

About Panoro

Panoro is a uniquely positioned Peru-focused copper development company. The Company is advancing its flagship Cotabambas Copper-Gold-Silver Project located in the strategically important area of southern Peru.

The Company’s objective is to complete a Prefeasibility study in 2023 with work programs commencing in Q1 2022.

At the Cotabambas Project, the Company will first focus on delineating resource growth potential and optimizing metallurgical recoveries. These objectives are expected to further enhance the project economics as part of the Prefeasibility studies during 2022 and 2023. Exploration and step-out drilling from 2017, 2018 and 2019 have already identified the potential for both oxide and sulphide resource growth.

Summary of Cotabambas Project Resources

Project | Resource | Million | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) | CuEq |

Cotabambas1 Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 | 0.59 |

Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | 0.44 | |

@ 0.20% CuEq cutoff, effective October 2013, Tetratech | |||||||

| |||||||

A PEA has been completed for the Cotabambas Project, the key results are summarized below:

Summary of Cotabambas Project PEA2 Results

Key Project Parameters | Cotabambas Cu/Au/Ag Project1 | ||

Process Feed, life of mine | million | 483.1 | |

Process Feed, daily | tonnes | 80,000 | |

Strip Ratio, life of mine | 1.25 : 1 | ||

Before | NPV7.5% | million US$ | 1,053 |

IRR | % | 20.4 | |

Payback | years | 3.2 | |

After | NPV7.5% | million US$ | 684 |

IRR | % | 16.7 | |

Payback | years | 3.6 | |

Annual | Cu | thousand | 70.5 |

Au | thousand | 95.1 | |

Ag | thousand | 1,018.4 | |

Mo | thousand | - | |

Initial Capital Cost | million US$ | 1,530 | |

| |||

PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEAs will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. M.B.A., P.Eng, P.E.

President & CEO

FOLLOW Panoro Minerals

Twitter | LinkedIn | Facebook

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd. | Renmark Financial Communications Inc. |

CAUTION REGARDING FORWARD LOOKING STATEMENTS: Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Examples of forward-looking information and statements contained in this news release include information and statements with respect to:

- Panoro delineating growth potential at the Cotabambas Project, while optimizing project economics;

- mineral resource estimates and assumptions; and

- the PEAs, including, but not limited to, base case parameters and assumptions, forecasts of net present value, internal rate of return and payback.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. In some instances, material assumptions and factors are presented or discussed in this news release in connection with the statements or disclosure containing the forward-looking information and statements. You are cautioned that the following list of material factors and assumptions is not exhaustive. The factors and assumptions include, but are not limited to, assumptions concerning: metal prices and by-product credits; cut-off grades; short and long term power prices; processing recovery rates; mine plans and production scheduling; process and infrastructure design and implementation; accuracy of the estimation of operating and capital costs; applicable tax and royalty rates; open-pit design; accuracy of mineral reserve and resource estimates and reserve and resource modeling; reliability of sampling and assay data; representativeness of mineralization; accuracy of metallurgical test work; and amenability of upgrading and blending mineralization.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- risks relating to metal price fluctuations

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning or reclamation expenses, proving to be inaccurate

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro’s control

- risks relating to Panoro’s or its partners’ ability to enforce legal rights under permits or licenses or risk that Panoro or its partners will become subject to litigation or arbitration that has an adverse outcome

- risks relating to Panoro’s or its partners’ projects being in Peru, including political, economic and regulatory instability

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits

- risks relating to potential challenges to Panoro’s or its partners’ right to explore or develop projects

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances

- risks relating to Panoro’s or its partners’ operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict operations

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law

- risks relating to inadequate insurance or inability to obtain insurance

- risks relating to the fact that Panoro’s and its partners’ properties are not yet in commercial production;

- risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates

- risks relating to Panoro’s ability to raise funding to continue its exploration, development, and mining activities; and

- counterparty risk under Panoro’s agreements.

This list is not exhaustive of the factors that may affect the forward-looking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information. The forward-looking information contained in this news release is based on beliefs, expectations, and opinions as of the date of this news release. For the reasons set forth above, readers are cautioned not to place undue reliance on forward-looking information. Panoro does not undertake to update any forward-looking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.