Panoro Minerals Announces Closing of Sale of Antilla Copper Project. Click here to see the Press Release.

On December 3, 2021, the Company completed a sale of 75% of its interest in the Company’s

subsidiary, Antilla Copper, S.A. (“Antilla Copper”) which holds the Antilla project, an advanced stage

mineral exploration project (the “Antilla Project”).

The net smelter returns royalty (“NSR”) to Panoro over the life of the Antilla Project will include an

existing 2.0% NSR; and an additional 1.0% NSR if the Company’s ownership in Antilla Copper is

diluted to below 5%.

ABOUT THE PROJECT

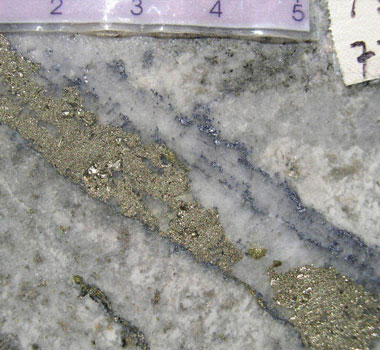

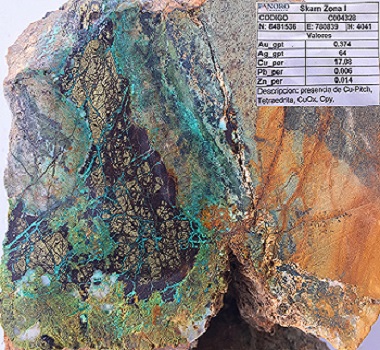

The Antilla project is a copper-molybdenum porphyry deposit, located 140 km south west of the city of Cusco, in the Apurimac region in Southern Peru. The hypogene copper mineralization was introduced by porphyry stocks outcropping in the property and is hosted in a sandstone sediments package with an extended development of supergene/secondary sulphide copper mineralization near the surface. The current mineral resources drilled cover an area of 1.5 km x 1.6 km but the exploration targets un-drilled and hosted in the sandstone cover an area of 3 km x 6 km suggesting a very attractive geologic potential open for exploration drilling.

The Antilla project has 15,386m of diamond drilling executed completed in five different campaigns between 2003 to 2010, and included mineral resource studies (updated three times between 2009 and 2015). Preliminary economic assessment (PEA) scenarios were completed in 2015 and updated in 2018 to assess:

- Flotation Processing Plant, and/or

- Heap Leach SX/EW

All studies and work completed are in accordance with the Canadian National Instrument 43-101.

EXPLORATION CAMPAIGNS

Southern Peru Copper S.A., 1999

In 1999 Southern Peru Copper S.A. carried out regional exploration work on the property including drilling on an optioned property immediately to the east of what became the Antilla project area.

Cordillera de Las Minas S.A., 2002 - 2005

In 2002, Cordillera de Las Minas S.A (CDLM) explored Peru for large copper deposits. Anaconda Peru S.A., a Peruvian subsidiary of Antofagasta Plc, transferred ownership of several groups of exploration concessions in southern Peru to CDLM, including Antilla.

In 2002, CDLM carried out soil geochemical exploration and followed up anomalous responses to the west of Calvario Hill, where Southern Peru had worked, and staked the first 2,800 hectares of mineral concessions. In 2003, geological mapping and geophysical surveys led to a drilling program in September 2003 that extended into 2004. Ten drill holes totalling 1,983.1 metres were drilled. In 2004, CDLM drilled 12 drill holes totalling 1,378.9 meters. In 2005, the CDLM joint venture returned to the eastern area of the property to complete an additional 4 drill holes totalling 650.1 metres in an attempt to extend the known mineralization to the north and southwest.

Panoro Minerals, 2008 - 2010

From 2008 to 2010 Panoro Minerals carried out additional mapping, surface rock and soil geochemical sampling, and diamond drill testing of previously identified geological, geochemical, and geophysical anomalies. In total, 49 drill holes totalling 9,130.6 m were drilled.

Chancadora Centauro, 2010 - 2012

From 2010 to 2012, Chancadora Centauro S.A. carried out additional mapping, surface rock and soil geochemical sampling, and diamond drill testing of previously identified geological, geochemical anomalies. In total, 19 drill holes totalling 2,242.8 m were drilled.

Table 1: Drilling Campaigns Summary

| Year | No. Holes | Metres |

|---|---|---|

| 2003 | 12 | 1,983 |

| 2004 | 12 | 1,379 |

| 2005 | 4 | 650 |

| 2008 | 49 | 9,131 |

| 2010 | 19 | 2,243 |

| Total | 96 | 15,386 |

Panoro Minerals, 2012 - Present

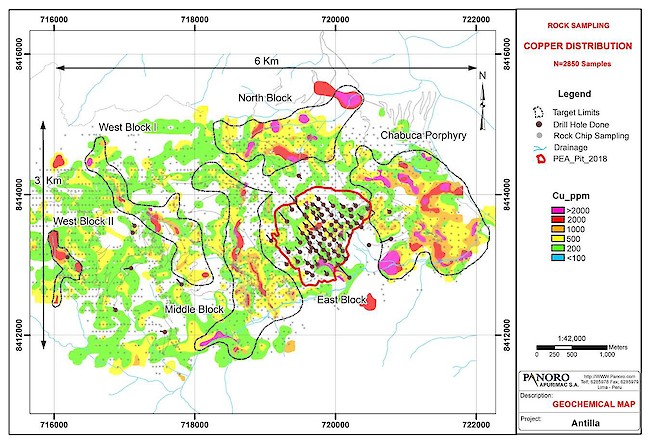

From 2012 to the present Panoro Minerals carried out additional mapping, surface rock and soil geochemical sampling over an area of 3 km by 6 km following the same lithological stratabound control hosting the mineral resources. See accumulated results below in Figure 1.

Figure 1: Ground copper anomalies over an area of 3km x 6km around the current mineral resources. Information supported by 2,850 rock samples. Panoro Exploration Team (up to 2018).

MINERAL RESOURCES ESTIMATION

Mineral Resources Estimated by Amec 2009

In June 2009 Amec Peru published a Mineral resource in accordance with the 2005 CIM Definition Standards estimating 156.9 million tonnes averaging 0.46% Cu and 0.009% Mo as inferred category above a 0.25% Cu cut-off grade. The pit-shell constraining the mineral resources was estimated to be 70.5 Mt grading 0.56% Cu, and 0.0115 Mo above a cutoff of 0.25% Cu.

Mineral Resources Estimated by Tetra Tech 2013-2015

In December 2013 Tetra Tech updated the mineral resource with additional drilling, estimating 188.5 Mt averaging 0.40% Cu, 0.009% Mo as Indicated category and 145.9 Mt grading 0.28% Cu, 0.009% Mo as Inferred category. Then, in October 2015 Tetra Tech updated the mineral resource resulting in 291.8 Mt grading 0.34% Cu, 0.01% Mo as Indicated category and 90.5 Mt averaging 0.26% Cu, 0.007% Mo as Inferred category.

The revised reporting methodology for the 2015 Mineral Resource; shown on tables 2 and 3 below, resulted in a positive and significant net redistribution of material from inferred to indicated compared to the 2013 mineral resource estimation. The primary reason for the change includes a revised pit shell used to constrain mineral resources reporting, a drop in reporting cut-off grade from 0.20 Cueq% to 0.175 Cueq% and the unique distribution of grade within the deposit.

Table 2: Indicated Mineral Resources

| Domain | Millon Tonnes | Cu % | Mo % | Cueq% |

|---|---|---|---|---|

| Overburden/Cover | 5.6 | 0.25 | 0.01 | 0.28 |

| Leach Cap | 13.4 | 0.25 | 0.01 | 0.27 |

| Supergene | 168.9 | 0.41 | 0.01 | 0.42 |

| Primary Sulphides | 103.9 | 0.24 | 0.01 | 0.26 |

| Total Indicated | 291.8 | 0.34 | 0.01 | 0.36 |

Table 3: Inferred Mineral Resources

| Domain | Millon Tonnes | Cu % | Mo % | Cueq% |

|---|---|---|---|---|

| Overburden/Cover | 0.50 | 0.22 | 0.009 | 0.24 |

| Leach Cap | 13.40 | 0.21 | 0.008 | 0.22 |

| Supergene | 25.90 | 0.34 | 0.008 | 0.36 |

| Primary Sulphides | 50.70 | 0.24 | 0.007 | 0.25 |

| Total Inferred | 90.50 | 0.26 | 0.007 | 0.28 |

PRELIMINARY ECONOMIC ASSESSMENTS (PEA)

The project has completed two Preliminary Economic Assessments, assessing two different operating scenarios:

- Mining of both primary and secondary sulphides by processing with conventional flotation.

- Mining of principally the near surface secondary sulphides by processing with heap leach and SX/EW.

Preliminary Economic Assessment-PEA by SRK and Moose Mountain Technical Services Ltd 2016

In June 2016 SRK and MMT completed a PEA in accordance with the Canadian National Instrument 43-101 and based on the Mineral Resources updated by TetraTech in 2015, including primary and supergene sulphides to concentrate copper in a flotation processing plant.

The considered operation includes a mine plan with 291.1 million tonnes averaging 0.32% Cu, 0.0089% Mo classified as Indicated resource and 59.8 million tonnes averaging 0.25% Cu, 0.0071% Mo as Inferred resource.

Highlight results include:

- After-tax NPV(7.5%) is US$ 225 million, IRR is 15.1% and payback estimated at 4.1 years.

- Conventional open pit mining and flotation processing.

- Design throughput of 40,000 tonnes per day with an operational life of mine of 24 years.

- Low waste to mill feed ratio of 0.85:1.

- Average annual payable copper of 81 million pounds and payable molybdenum of 1.9 million pounds.

- Average direct cash costs (C1) of US$ 1.83 per pound of payable copper, net of byproduct credits.

- Initial project capital cost is US$ 603 million, including contingencies.

- Good potential for discovery of additional mineralization adjacent mineral resource area.

Metallurgical testwork was completed in 2013 by Certimin Laboratories S.A. in Lima, Peru on individual samples of Supergene and Primary Sulphides mineralized material, obtaining average Cu recovery of 85% and 67.5% Mo. The product is a clean and commercial copper concentrate with molybdenum premium.

Opportunities for project growth and enhanced economics include an extension of the current exploration drilling to the exploration targets located around the mineral resources pit. The targets include a number of high grade copper anomalies based on 2,850 rock samples took over an area of 6 km by 3 km (Figure 1). Also, considering the very preliminary metallurgical testwork undertaken on the project to date, there is potential to increase recoveries with additional metallurgical testing and to improve discrimination between metallurgical ore types within the deposit.

The PEA technical report is posted on SEDAR and a link to the report is included below.

Preliminary Economic Assessment PEA by Moose Mountain 2018

In June 2018 MMT published an update of Antilla’s PEA to a Copper Project heap including a leach and SX/EW Operation for the near surface supergene sulphides.

Highlights results include:

- After-tax NPV7.5% is US$ 305.4 million, IRR is 25.9% and 3 years payback.

- Conventional open pit mine focused on supergene copper sulphides.

- Heap Leach and Solvent Extraction Electrowinning (SX/EW) process.

- Design throughput of 20,000 tonnes per day with an operational mine life of 17 years.

- Low waste to mill feed ratio of 1.38:1.

- Average annual payable copper of 46.3 million pounds, as Cathodes.

- Average direct cash costs (C1) of US$ 1.51 per pound of payable copper.

- Initial Project capital costs of US$ 250.4 million, including contingencies.

- Good potential for discovery of additional supergene mineralization adjacent to the current mineral resource area.

The mine plan of the PEA includes 113.3 million tonnes averaging 0.45% Cu of Indicated Mineral Resources and 5.4 million tonnes grading 0.26% Cu of Inferred Mineral Resources.

Preliminary metallurgical characterisation testwork was initiated at Aminpro Laboratories in November 2017 and completed in March 2018, under the direction of Tetra Tech Mining and Minerals. Aminpro Laboratories is fully certified under both ISO 9001 and 1400. The testwork program comprises quantitative mineralogical analysis, sulphuric acid and ferric sulphate bottle roll predictor tests and column leach tests aimed at characterising the copper leaching characteristics of supergene mineralogical materials. Results from the predictor tests indicate that 82% Cu extraction is available for secondary copper minerals, close to theoretical copper extractions being achieved. However, the column tests were finished after the PEA 2018, and completed by September 2018 with 87.7% Cu extractions. No test work has been conducted on the cover, cap and primary sulphide domains as these constitute only minor portions of the deposit.

The redesign of the Antilla project has resulted in significantly improved project economics. The mine plan has focused on the higher grade, near surface secondary sulphides, which are amenable to processing through heap leaching, solvent extraction, and electrowinning (LIX-SX-EW). As a result, the initial capital costs have been reduced by 59%, the C1 cash costs reduced by 18%, the C2 cash costs by 23% and the sustaining capital required for a tailings facility has been eliminated. The base case, after tax NPV(7.5) has increased 36%, the IRR has increased 11% and the payback period has been reduced by 27%. Over 95% of the mineralized material contained in the mine plan is classified as Indicated.

Column leach testing following the completion of the PEA indicated the potential to increase the recovery of copper from the SX/EW plant from the 72.5% included in the PEA to 79.9%. The potential increased recovery could result in the addition of approximately 50 million tonnes of resource to the mine plan.

Further work leading to a Pre-Feasibility or Feasibility Study is recommended and will include drilling, mineral resource modeling, metallurgical testwork, engineering, and marketing studies, hydrological and geotechnical analysis, as well as various baseline environmental and archeological studies. In addition, exploration work will be recommended over the other targets in the vicinity of the known deposits.

The improved Antilla project is now near the lower quartile of new copper projects in terms of both cash costs and capital intensity. The much reduced $250 million initial capital cost will facilitate a broader range of strategic financing and/or development approaches to advancing the Antilla project through feasibility studies and into development and operation. Panoro is pleased to have achieved the objective of optimizing the Antilla Project and looks forward to advancing the strategic plan for this project.

The PEA technical report is posted on SEDAR and a link to the report in included below.

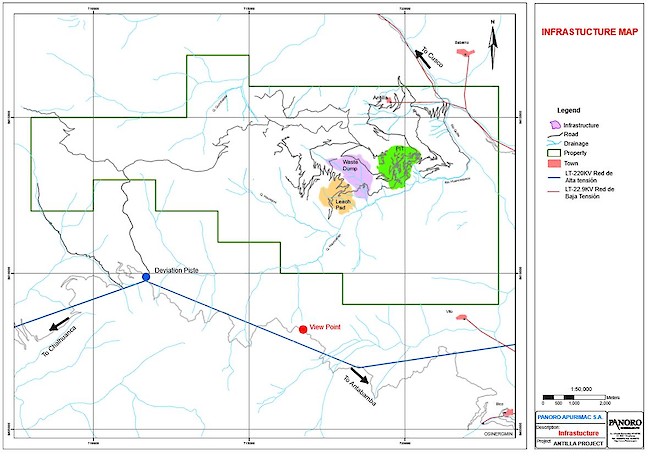

Figure 02: Infrastructure Layout Map. The power line interconnected with the national grid pass between 5km to 7km to the south of the property.

Luis Vela, P. Geo., Vice President of Exploration for Panoro and a "qualified person" under National Instrument 43-101, has reviewed and approved the scientific and technical information.