Documento Relacionado

Vancouver, B.C., June 23, 2014 - Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") Panoro is pleased to report results of on-going exploration work at its 100% owned Cotabambas porphyry copper-gold-silver-molybdenum project located in southern Peru.

Geological mapping and chip sampling on the property have continued to outline a number of porphyry-style copper+-gold mineralized zones outside of the main Ccalla resource for which a Preliminary Economic Assessment is expected in September 2014. The presence of multiple intrusions and zones of porphyry and skarn mineralization with anomalous copper, gold, silver, molybdenum and other elements over an area of about 4 km by 8km suggests the possibility of a cluster of porphyry centres similar to the situation at Las Bambas and other significant porphyry camps.

Structural and geological mapping suggest that these new zones are aligned in two main northeasterly trends. Other than the main Ccalla and nearby Azulccacca zones, most of these targets have not been drilled as yet and all represent prime targets for continued exploration with the potential to significantly increase the property resource base.

Figure 1 shows the two mineralized trends and main target areas for continued work, including the Maria Jose, Guacclle and Buenavista zones.

MARIA JOSE ZONE

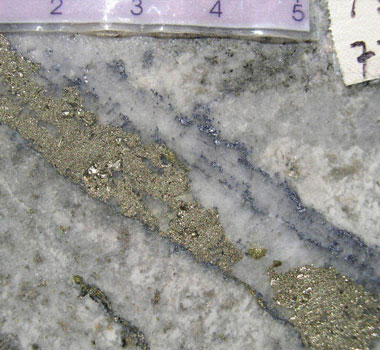

The Maria Jose zone is situated along the same mineralized trend as the Ccalla and Azulccaca deposits. It includes two separate prospects consisting of both oxide and primary copper mineralization associated with quartz monzonite porphyry intruding monzodiorite and andesite. Mineralization is characterized by differing proportions of chrysocolla, cuprite, goethite, hematite, and minor chalcocite and chalcopyrite associated with quartz stockwork veinlets. The mineralized porphyries exhibit potassic and phyllic alteration while the host rocks show differing levels of propylitic alteration, sometimes overprinted by a pyrite-chalcopyrite-quartz stockwork.

Within the Maria Jose area, the MJ-1 prospect is defined by 25 rock chip samples with greater than 500 ppm Cu over an area of 300m by 900m . A higher grade "core" area of 130m x 500m in size is defined by 17 samples that assayed from 0.11% Cu to 0.39% Cu, 0.01 to 0.05 Au g/t, and 0.3 to 3.1 g/t Ag.

The MJ-2 prospect is defined by 70 rock chip samples with greater than 500ppm Cu over an area of 250m by 1,100m. A 200m x 350m higher grade "core" area within this anomaly is defined by 25 samples containing 0.20% Cu to 0.44 %Cu, 0.01g/t Au to 0.07g/t Au and 0.2g/t Ag to 3.0 g/t Ag. A second and smaller "core" within the larger prospect area is defined by 8 samples grading from 0.52% Cu to 1.56% Cu, 0.03g/t Au to 0.47g/t Au and 1.5g/t Ag to 7.9g/t Ag.

Several trenches were excavated where outcrop was available. All showed mineralization and alteration. The best two are situated more or less end to end and exhibit an average of 1.02% Cu, 0.21 g/t Au, 4.75 g/t Ag and 4.24 ppm Mo over approximately 58 metres. The MJ-1 and MJ-2 anomalies are open to the east and west and represent attractive targets for both drilling of exposed mineralization and geophysics to test for extensions under cover to both sides.

The area between the Maria Jose and Ccalla zones is known as Cochapata. Most of this area is covered by soils and colluvium, but in some places, quartz monzonite porphyry with pervasive advanced argillization, limonite and relicts of hydrothermal quartz veins with breccia texture is found in outcrop, suggesting the possibility of a leached cap over porphyry style mineralization. This in turn suggests that the Maria Jose and Ccalla zones may be connected.

GUACLLE-BUENAVISTA TREND

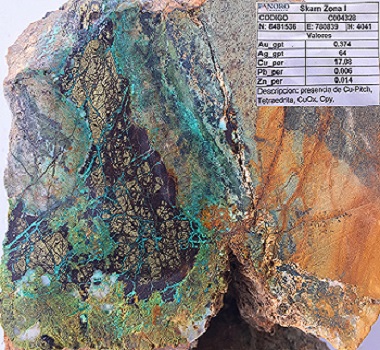

A second mineralized trend is situated immediately northwest of the Maria Jose-Ccalla-Azulccacca trend and includes the Buenavista and Guaclle zones. It is characterized by both oxide and primary copper mineralization associated with potassically altered quartz monzonite porphyry intruding propylitically altered diorite. Mineralization is similar to that in the Ccalla area but may be somewhat more eroded and phyllic alteration is less common. In some places, roof pendants of limestone show prograde and retrograde skarn alteration with iron and copper mineralization.

Six holes have been drilled in the Guaclle area, two of which include numerous intervals of oxide and supergene-enriched copper mineralization ranging from six metres grading 1.32% Cu to 12 metres grading 0.76% Cu. The results of surface chip sampling in the Buena Vista area were more anomalous than those at Guaclle but this zone has not yet been drilled.

Further to the south along both trends, additional porphyry and skarn type mineralization occur in carbonate rocks, such as at the Jean Louis, Ccarayoc and Chuyllullo targets. At the Cullusayhua target, sampling of hydrothermal breccia hosted by iron oxide stained quartzite returned anomalous gold and silver values. Other skarn mineralization is being mapped and sampled in the Chaupec and Añarqui areas.

In addition to working towards a Q3 release of the Preliminary Economic Assessment of the Ccalla and Azulccacca deposits, the Company is continuing to explore these outlying zones with geological mapping, geochemical sampling and geophysics to define targets for drilling.

Luquman Shaheen, the Company's President & CEO, states, "The exploration work at Cotabambas continues to demonstrate the large geologic potential of the project. Since 2007 the project has grown in scale from 90 Mt of inferred resources to 117 Mt of indicated plus 605 Mt of inferred resources. The ongoing work gives the Company confidence that the scale of the project has very good potential to increase in the future as the exploration work is advanced. This growth potential, together with the very significant resources already defined, are strong indications that the Cotabambas Project is the next key copper project in the most important copper development region of Peru".

About Panoro

Panoro is advancing its significant portfolio of copper and gold projects in the key Andahuaylas-Yauri belt in south central Peru, including its advanced stage Cotabambas Copper-Gold-Silver-Molybdenum and Antilla Copper-Molybdenum Projects. Since 2007, the company has completed over 70,000 m of exploration drilling at these two key projects leading to the delineation of mineral resources in late 2013 of:

| Cotabambas: | Indicated Resource 117.1 Mt @ 0.42% Cu, 0.23g/t Au, 2.74 g/t Ag & 0.001%Mo (@0.2% Cueq cutoff) Inferred Resource 605.3 Mt @ 0.31% Cu, 0.17g/t Au, 2.33 g/t Ag and 0.002 %Mo (@0.2% Cueq cutoff) (Tetra Tech, 2013). | |

| Antilla: | Indicated Resource 188.5 Mt @ 0.40% Cu and 0.009% Mo (@0.2% Cueq cutoff) Inferred Resource 145.9 Mt @ 0.28% Cu and 0.009%Mo (@0.2% Cueq cutoff) (Tetra Tech, 2014). | |

Panoro continues its exploration at the Cotabambas project while a Metallurgical testing program and Preliminary Economic Assessment (PEA) is underway by AMEC Americas Ltd. The PEA is due for completion in Q3 2014.

A PEA for the Antilla Project is also planned for completion in Q3 2014. The moderate scale of the resource at the Antilla Project together with strong infrastructure in the area may result in a moderate capital cost development plan for the project.

In addition to the Cotabambas and Antilla Projects, Panoro's portfolio includes more than 10 earlier stage projects in the same region of south central Peru. Peru's national objective of doubling copper production together with the development of the many copper projects in the region, together with the private and public investments into rail, road, power generation and transmission and port infrastructure are leading to the rapid growth of an important global center for copper production. Panoro's large portfolio is situated here along with the Las Bambas, Tintaya, Antapaccay, Haquira, Constancia, Los Chancas and Trapiche projects, all of which are either in construction or already in production.

Panoro is very well positioned to advance exploration at the Antilla and Cotabambas Projects. The Company has $6 million in cash, which will allow completion of additional drilling and preliminary economic assessments as both projects move towards feasibility studies.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen, M.B.A., P.Eng., P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd.

Luquman Shaheen, President & CEO

Phone: 604.684.4246

Fax: 604.684.4200

Email: info@panoro.com

Web: www.panoro.com

Renmark Financial Communications Inc.

Barbara Komorowski:

bkomorowski@renmarkfinancial.com

Tel.: (514) 939-3989 or (416) 644-2020

www.renmarkfinancial.com

This release was prepared by management of the Company who takes full responsibility for its contents. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.