Vancouver, B.C., July 16, 2014 - Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") is pleased to announce that it has completed its previously announced bought deal public equity financing through its underwriters, National Bank Financial Inc. and Laurentian Bank Securities Inc. (the "Underwriters"). In conjunction with the completion of the bought deal financing, the Underwriters exercised the over-allotment option granted to them by the Company. Including the common shares issued pursuant to the exercise of the over-allotment option, a total of 13,800,000 common shares of the Company were issued and sold at a price of C$0.42 per common share for gross proceeds of C$5,796,000.

The Underwriters received a cash commission of C$347,760 representing 6% of the gross proceeds of the bought deal financing.

The Company also announces that it has completed its previously announced non-brokered private placement financing with Hudbay Minerals Inc. ("Hudbay") whereby Hudbay maintained its pro-rata ownership in Panoro of approximately 11.2%. A total of 1,734,897 common shares were issued and sold to Hudbay at a price of C$0.42 per common share for gross proceeds of C$728,656.74. The common shares issued to Hudbay are subject to a hold period expiring on November 17, 2014.

The Company intends to use the net proceeds from the bought deal and private placement financings to fund the continued exploration and development of the Company's Cotabambas and Antilla projects.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The Securities have not been and will not be registered under the United States Securities act of 1933, as amended, or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless an exemption from such registration is available.

About Panoro

Panoro is advancing its significant portfolio of copper and gold projects in the key Andahuaylas-Yauri belt in south central Peru, including its advanced stage Cotabambas Copper-Gold-Silver-Molybdenum and Antilla Copper-Molybdenum Projects.

Since 2007, the company has completed over 70,000 m of exploration drilling at these two key projects leading to the delineation of mineral resources in late 2013 of:

| Cotabambas: | Indicated Resource 117.1 Mt @ 0.42% Cu, 0.23g/t Au, 2.74 g/t Ag & 0.001%Mo (@0.2% Cueq cutoff) Inferred Resource 605.3 Mt @ 0.31% Cu, 0.17g/t Au, 2.33 g/t Ag and 0.002 %Mo (@0.2% Cueq cutoff) (Tetra Tech, 2013). | |

| Antilla: | Indicated Resource 188.5 Mt @ 0.40% Cu and 0.009% Mo (@0.2% Cueq cutoff) Inferred Resource 145.9 Mt @ 0.28% Cu and 0.009%Mo (@0.2% Cueq cutoff) (Tetra Tech, 2014). |

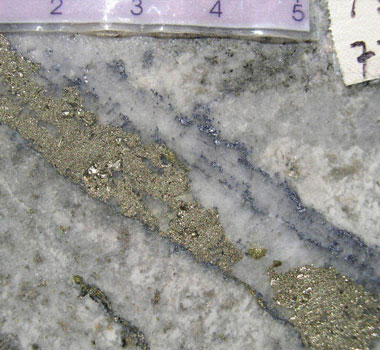

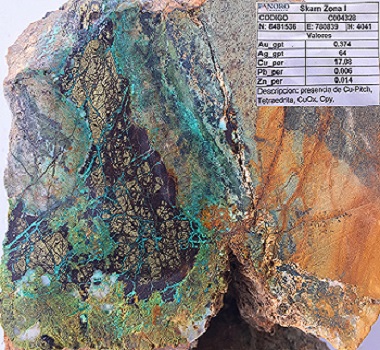

Panoro continues its exploration and drilling at the Cotabambas project while a Preliminary Economic Assessment (PEA) is underway by AMEC Americas Ltd. The PEA is due for completion in the fall of 2014. The already significant resource, together with significant geologic potential demonstrate the potential for a large scale open pit mine at the project. To date exploration at the Cotabambas Project has focused on the Ccalla and Azulccaca deposits. However, at least eight other porphyry and skarn target zones have been identified within the company's Cotabambas mineral concession blocks. Drilling at these targets is planned.

A PEA for the Antilla Project is also planned for completion in the fall of 2014. The moderate scale of the resource at the Antilla Project together with strong infrastructure in the area may result in a moderate capital cost development plan for the project.

In addition to the Cotabambas and Antilla Projects, Panoro's portfolio includes more than 10 earlier stage projects in primarily the same region of south central Peru. Peru's national objective of doubling copper production together with the development of the many copper projects in the region, together with the private and public investments into rail, road, power generation and transmission and port infrastructure are leading to the rapid growth of an important global center for copper production. Panoro's large portfolio is situated here along with the Las Bambas, Tintoya, Antapaccay, Haquira, Constancia, Las Chancas and Trapinche projects all of which are either in exploration stage, construction or already in production.

Luis Vela, a P. Geo Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman A. Shaheen, M.B.A., P.Eng., P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd. | Renmark Financial Communications Inc. |

This release was prepared by management of the Company who takes full responsibility for its contents. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.