Documento Relacionado

Vancouver, B.C., October 11, 2017 - Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") is pleased to provide an update of its exploration drill program at its 100% owned Cotabambas Cu/Au/Ag Project in Peru. Highlights are as follows:

- Petra-David Target, Drillhole CB-171 intercepted a quartz monzonite porphyry from surface to 19.0 m with oxide copper mineralization grading 0.35% Cu, 0.09 g/t Au and 2.7 g/t Ag, including 10.8 m averaging 0.44% Cu, 0.12 g/t Au and 2.8 g/t Ag, underlain by a second blanket from 40.8 m to 90.1 m of oxide copper mineralization grading 0.24% Cu, 0.07 g/t Au and 1.7 g/t Ag, including 30.2 m averaging 0.32% Cu, 0.09 g/t Au and 2.2 g/t Ag, and 12.2 m grading 0.40% Cu, 0.09 g/t Au and 3.2 g/t Ag.

- Petra-David Target, Drillhole CB-173 intersected from 6.6 m to 68.0 m oxide copper mineralization within a quartz monzonite porphyry with grades averaging 0.38% Cu, 0.10 g/t Au and 4.9 g/t Ag, including 27.1 m grading 0.58% Cu, 0.14 g/t Au and 2.9 g/t Ag.

- Maria Jose Target, Drillhole CB-165 intersected from 4.5 m to 17.7 m a oxide copper mineralization within an andesite volcanic package averaging 0.41% Cu, 0.06 g/t Au and 2.3 g/t Au, underlain by 2.7 m of mixed copper mineralization grading 1.03% Cu, 0.11 Au g/t, 6.8 Ag g/t, and underlain also by three intervals of primary copper mineralization between 18.2 m to 93.0 m depth grading between 0.24% Cu to 0.78% Cu, 0.03 g/t Au to 0.12 g/t Au, and 1.3 g/t Ag to 2.7 g/t Ag.

“The multiple exploration targets at the Cotabambas Project are yielding results which reinforce Panoro’s belief in the project’s growth potential.”, commented Luquman Shaheen, President and CEO of Panoro. “The first drill holes at the Petra-David Target have intersected near surface oxide mineralization. Additional drill holes at Maria Jose continue to intersect mineralization with high grade intervals. Additional drilling at these targets continues. The Cateo-Puente drill holes indicate potential for additional mineralization in this area also. These targets, together with the Breccia Target, are located over an area of approximately 2 km by 2 km to the north side of the current resource limits and along the northeast-southwest local faulting. We remain focused on continuing to demonstrate the significant growth potential at these targets within Cluster 1 while we proceed with expanding our exploration permit to include Cluster 2 and the Chaupec Target.”

Petra-David Target

The Petra-David target is located 500 m to 800 m to the west-northwest of the western limit of the PEA pit at an elevation of 250 m lower than the pit limit. Approximately 95% of the area is covered by soil and colluvium, but a rock chip geochemical survey together with the IP and magnetic results define a northeasterly trending, 800 m long corridor of copper-gold mineralization here.

Drillholes CB-171 and CB-173 are the first holes in the drill program recently commenced at the southern limit of this corridor (Petra zone). The drill hole program will step out progressively to the northeast (to David zone). The following table details the more significant intersections from the upper portion of the drill holes. A location plan can be found at the Company’s website, www.panoro.com

Drillhole | From (m) | To (m) | Metres (m) | Cu % | Au g/t | Ag g/t | Mo % | Zone |

CB-171 | 0.0 | 25,0 | 25.0 | 0.32 | 0.08 | 2.6 | 0.0021 | Oxides |

Including | 0.0 | 10.8 | 10.8 | 0.44 | 0.12 | 2.8 | 0.0036 | Oxides |

" " | 40.8 | 71.0 | 30.2 | 0.32 | 0.09 | 2.2 | 0.0027 | Oxides |

Including | 40.8 | 53.0 | 12.2 | 0.40 | 0.09 | 3.2 | 0.0017 | Oxides |

CB-173 | 6.6 | 68.0 | 61.4 | 0.38 | 0.10 | 4.9 | 0.0027 | Oxides |

Including | 8.1 | 35.2 | 27.1 | 0.58 | 0.14 | 2.9 | 0.0027 | Oxides |

Drillhole CB-171 intersected 69.0 m of quartz monzonite porphyry hosting the two oxide copper blankets described above and crosscut from 19.0 m to 40.8 m length by a latite dike.

Drillhole CB-173 targets a geochemical anomaly defined at surface and has intersected oxide mineralization from near surface and is currently advancing through a quartz monzonite porphyry with potassic and phyllic alteration intruding a diorite with propylitic alteration.

Maria Jose Target

Drillhole CB-165 was completed on Line 1N between holes CB-161 and CB-163, the results of which were previously published, and targeted the near surface oxide copper blanket intersected by those holes. From

4.5 m to 15.5 m CB-165 intersected 11.0 m of oxide copper mineralization averaging 0.41% Cu and 0.06 g/t Au, successively underlain by 2.7 m of a mixed zone grading 1.03% Cu and 0.11 g/t Au and underlain by three intervals of primary copper mineralization from 13.0 m to 19.4 m depth averaging from 0.24% Cu to 0.44% Cu, including intervals with higher copper grades.

Drillholes CB-164 and CB-167 were located 200 m to the west and follow the same IP geophysical signature and gold geochemical anomalies related to iron oxides at surface. These drill holes intersected copper and gold values in propylitically altered andesite volcanic which may represent a more peripheral type of mineralization associated with potassically and phyllically altered mineralized porphyry that was intersected along the Line 1N. The geophysical signatures and the copper grades intersected to date in this area suggest that pathways of mineralization could trend to the east and northeast, and will be investigated with additional drilling.

The following table details the more significant intersections. A location plan can be found at the Company’s website, www.panoro.com

Drillhole | From (m) | To (m) | Metres (m) | Cu % | Au g/t | Ag g/t | Mo % | Zone |

CB-164 | 4.0 | 17,7 | 13.7 | 0.15 | 0.01 | 1.9 | 0.0008 | Oxides |

" " | 23.4 | 35,2 | 11.8 | 0.17 | 0.01 | 0.9 | 0.0010 | Oxides |

" " | 121.0 | 151,0 | 30.0 | 0.13 | 0.01 | 0.7 | 0.0004 | Oxides |

" " | 163.0 | 214,0 | 51.0 | 0.12 | 0.01 | 0.7 | 0.0019 | Primary |

CB-165 | 4.5 | 15,5 | 11.0 | 0.41 | 0.06 | 2.3 | 0.0002 | Oxides |

" " | 15.5 | 18,2 | 2.7 | 1.03 | 0.11 | 6.8 | 0.0004 | Mixed |

" " | 18.2 | 32.9 | 14.7 | 0.32 | 0.04 | 1.3 | 0.0014 | Primary |

" " | 47.0 | 60.0 | 13.0 | 0.24 | 0.03 | 1.6 | 0.0121 | Primary |

" " | 73.6 | 93.0 | 19.4 | 0.44 | 0.06 | 1.8 | 0.0016 | Primary |

Including | 75.2 | 79.2 | 4.0 | 0.78 | 0.12 | 2.5 | 0.0008 | Primary |

Including | 89.0 | 92.0 | 3.0 | 0.71 | 0.08 | 2.7 | 0.0019 | Primary |

CB-167 | 18.2 | 26.5 | 8.3 | 0.02 | 0.29 | 0.5 | 0.0002 | Leach Cap |

Including | 18.2 | 19.5 | 1.3 | 0.04 | 1.51 | 0.5 | 0.0004 | Leach Cap |

" " | 85.5 | 99.1 | 13.6 | 0.10 | 0.01 | 0.6 | 0.0056 | Oxides |

Cateo-Puente Target

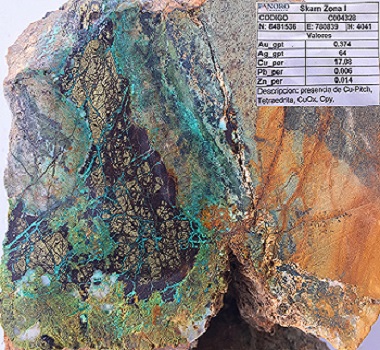

The Cateo-Puente Target is located between 600 m and 1,000 m to the northeast of the David Target, and may represent a possible connection with the N°1 copper-gold anomaly of the Buenavista target (see map at the company’s website). At Cateo-Puente a number of outcrops of porphyry and skarn mineralization have been mapped within the access road cuts. Three drill holes were completed in this target area. The following table details the more significant intersections. A location plan can be found at the Company’s website, www.panoro.com

Drillhole | From (m) | To (m) | Metres (m) | Cu % | Au g/t | Ag g/t | Mo % | Zone |

CB-159 | 43.8 | 71.8 | 28.1 | 0.02 | 0.01 | 0.6 | 0.0004 | Primary |

CB-160 | 45.1 | 48.5 | 3.4 | 0.07 | 0.47 | 2.2 | 0.0001 | Primary |

" " | 57.0 | 70.0 | 13.0 | 0.03 | 0.27 | 0.8 | 0.0011 | Primary |

Including | 64.1 | 65.0 | 0.9 | 0.04 | 0.99 | 0.6 | 0.0007 | Primary |

" " | 77.0 | 79.0 | 2.0 | 0.06 | 0.53 | 0.5 | 0.0004 | Primary |

" " | 91.5 | 93.0 | 1.5 | 0.28 | 1.06 | 1.8 | 0.0008 | Primary |

" " | 275.1 | 27.5 | 0.4 | 0.64 | 1.34 | 7.2 | 0.0005 | Primary |

" " | 298.3 | 298.9 | 0.6 | 0.32 | 0.05 | 3.1 | 0.0029 | Primary |

" " | 306.5 | 306.8 | 0.4 | 0.51 | 0.37 | 3.8 | 0.0016 | Primary |

" " | 310.5 | 311.2 | 0.7 | 0.40 | 0.08 | 2.6 | 0.0019 | Primary |

" " | 388.4 | 390.3 | 1.9 | 0.74 | 0.01 | 0.9 | 0.0005 | Primary |

CB-170 | 42.7 | 163.9 | 121.2 | 0.10 | 0.02 | 0.6 | 0.0025 | Primary |

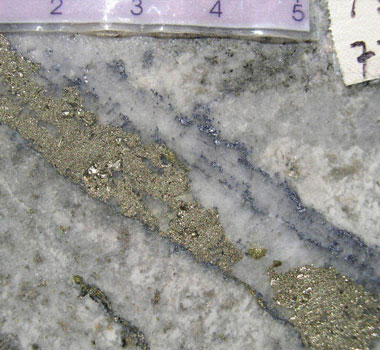

Drillhole CB-160, intersected a quartz monzonite porphyry with weakly potassic alteration intruding limestones and andesite volcanics. The volcanics exhibit propylitic alteration and host three veins with quartz and pyrite varying from 0.9 m to 13.0 m in width with grades varying from 0.27 g/t Au to 1.06 g/t Au. The limestones host as many as five veins varying in width from 0.4 m to 3.4 m with grades of 0.32% Cu to 0.74% Cu and 0.01 g/t Au to 1.34 g/t Au. The veins exhibit skarn type alteration/mineralization at their margins.

Drillholes CB-159 and CB-170 intersected anomalous gold and copper values at a contact between andesite volcanics and a quartz monzonite porphyry with weakly potassic alteration.

The results at Cateo-Puente indicate potential for skarn-type mineralization which is typically somewhat erratic, particularly near its margins.

About Panoro

Panoro Minerals is a uniquely positioned Peru focused copper exploration and development Company. The Company is advancing its flagship project, Cotabambas Copper-Gold-Silver Project and its Antilla Copper- Molybdenum Projects located in the strategically important area of southern Peru. The company is well financed to expand, enhance and advance its projects in the region where infrastructure such as railway, roads, ports, water supply, power generation and transmission are readily available and expanding quickly. The region boasts the recent investment of over $US 15 billion into the construction or expansion of four large open pit copper mines.

Since 2007, the Company has completed over 70,000 m of exploration drilling at these two key projects leading to substantial increases in the mineral resource base for each, as summarized in the table below.

Summary of Cotabambas and Antilla Project Resources

Project | Resource Classification | Million Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

Cotabambas Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 |

Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | |

@ 0.20% CuEq cutoff, effective October 2013, Tetratech | ||||||

Antilla Cu/Mo | Indicated | 291.8 | 0.34 | - | - | 0.01 |

Inferred | 90.5 | 0.26 | - | - | 0.007 | |

@ 0.175% CuEq cutoff, effective May 2016, Tetratech | ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

Key Project Parameters | Cotabambas Cu/Au/Ag Project | Antilla Cu/Mo Project | ||

Mill Feed, life of mine | million tonnes | 483.1 | 350.4 | |

Mill Feed, daily | tonnes | 80,000 | 40,000 | |

Strip Ratio, life of mine | 1.25 : 1 | 0.85 : 1 | ||

Before Tax1 | NPV7.5% | million USD | 1,053 | 491 |

IRR | % | 20.4 | 22.2 | |

Payback | years | 3.2 | 3.3 | |

After Tax1 | NPV7.5% | million USD | 684 | 225 |

IRR | % | 16.7 | 15.1 | |

Payback | years | 3.6 | 4.1 | |

Annual Average Payable Metals | Cu | thousand tonnes | 70.5 | 36.8 |

Au | thousand ounces | 95.1 | - | |

Ag | thousand ounces | 1,018.4 | - | |

Mo | thousand tonnes | - | 0.9 | |

Initial Capital Cost | million USD | 1,530 | 603 | |

Project economics estimated at commodity prices of; Cu = US$3.00/lb, Au = US$1,250/oz, Ag = US$18.50/oz, Mo = US$12/lb | ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. PEng, PE, MBA President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd. Luquman Shaheen, President & CEO Email: info@panoro.com | Renmark Financial Communications Inc. Laura Welsh Tel.: (416) 644-2020 or (416) 939-3989 |

CAUTION REGARDING FORWARD LOOKING STATEMENTS : Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- risks relating to metal price fluctuations;

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning or reclamation expenses, proving to be inaccurate;

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro’s control;

- risks relating to Panoro’s ability to enforce Panoro’s legal rights under permits or licenses or risk that Panoro’s will become subject to litigation or arbitration that has an adverse outcome;

- risks relating to Panoro’s projects being in Peru, including political, economic and regulatory instability;

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits;

- risks relating to potential challenges to Panoro’s right to explore and/or develop its projects;

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances;

- risks relating to Panoro’s operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict Panoro’s operations;

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law;

- risks relating to inadequate insurance or inability to obtain insurance;

- risks relating to the fact that Panoro’s properties are not yet in commercial production;

- risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates; and

- risks relating to Panoro’s ability to raise funding to continue its exploration, development and mining activities.

This list is not exhaustive of the factors that may affect the forward-looking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information. The forward-looking information contained in this news release is based on beliefs, expectations and opinions as of the date of this news release. For the reasons set forth above, readers are cautioned not to place undue reliance on forward-looking information. Panoro does not undertake to update any forward-looking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.