Related Document

VANCOUVER, B.C., September 7, 2023 – Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM, OTCQB: POROF) ("Panoro", the "Company") is pleased to announce the results of four exploratory drill holes which intercept a new high grade Skarn type mineralization located less than 1 km to the west of the North Pit limit, at the Company’s Cotabambas Cu/Au/Ag Project in southern Peru. The new target is named the “North West Pit” Target (the “NW Target”)

The highlights are:

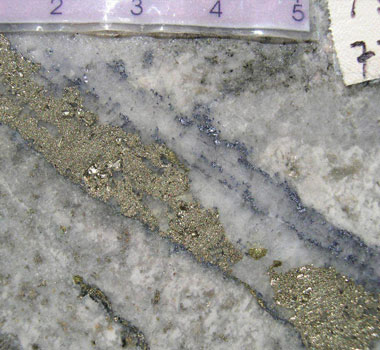

- Drillhole CB-225A is an exploratory hole intersecting 27.9 m of primary sulfide copper mineralization averaging 1.50% Cu, 5.79 g/t Ag, 0.01 g/t Au (1.56% Cueq), including an interval of 12.1m grading 2.07% Cu, 7.2 g/t Ag, 0.02 g/t Au (2.15% Cueq), and a second interval of 9.3m averaging 1.68% Cu, 6.17 g/t Ag, 0.02 g/t Au (1.75% Cueq). The mineralogy is composed of a semi-massive magnetite containing semi-massive and patch of chalcopyrite and minor pyrite, interlayering with massive andradite garnets, epidote, pyroxenes and intervals of marmolized limestone.

- Drillhole CB-227 is an exploratory hole intersecting 71.4m of hypogene copper mineralization grading 0.47% Cu, 2.46 g/t Ag, 0.02 g/t Au (0.51% Cueq), including an interval of 37.0 m averaging 0.75% Cu, 3.61 g/t Ag, 0.03 g/t Au (0.80% Cueq) and 14.9 m grading 1.26% Cu, 5.49 g/t Ag, 0.03 g/t Ag (1.33% Cueq). The skarn mineralization appears the same as intersected by the hole CB-225A, confirming the lateral and vertical continuity of the skarn bodies identified at surface.

- The NW Pit target is located approximately 500m to the west of the PEA North pit limit. In the 2017 exploration campaign the mapping and sampling identified 5 skarn bodies at surface over an area of 1200m by 800m. The 2023 drilling campaign has identified the continuity at depths to over 350m below the surface.

Luquman Shaheen, President & CEO commented, “Drillholes 225A and 227 have identified the growing potential of the mineralization at the Cotabambas Project. The recently completed drill program has opened up a number of growth opportunities for the resource including, to the south of the south pit, the gap area between the north and south pits, to the north of the north pit and now also to the northwest of the north pit. These targets, in addition to the targets at Chaupec and Jean Louis areas, continue to demonstrate the unfolding resource potential along the entire extent of Panoro’s mineral concessions covering an area of 120 square kilometers. We are targeting an update to the already significant resource at the Cotabambas Project for completion this month and look forward to quantifying the results of the 2022-2023 drilling program with the new resource estimate. Moreover, the current results reinforce management’s confidence in additional exploration upside.”

PREVIOUS WORK IN THE NW PIT AREA

The exploration work dates from Cordillera de Las Minas time (2003), where four drillholes (1,135m) explored a quartz-monzonite stock outcropping 300 to 500m in the “South Area”. In 2012 Panoro drilled one additional hole in different direction. No significant results were obtained (Map in Figure 1).

In 2017 Panoro started the exploration in the NW Pit target, identifying small outcroppings of quartz-monzonite porphyry dikes located 300m to the East of the “North Area”. This target was named the Petra-David target, where a swarm of porphyry dikes intrude the diorite host rock showing copper oxide mineralization near surface and along a corridor of 750m length by 150m width in North-East direction. In Petra 863m was drilled and in David 372m, distributed in very shallow drill holes, results were announced previously in press releases of October 11 and December 11, 2017. The most significant results in the copper oxide blanket are listed below. (locations Figure 1)

- Petra: Hole CB-171: 11m @0.44%Cu, 0.12 Au g/t, 2.8 Ag g/t (0.56%Cueq)

- Petra: Hole CB-172: 78m @ 0.32%Cu, 0.08 Au g/t, 2.2 Ag g/t (0.40%Cueq)

- Petra: Hole CB-173: 61m @0.38%Cu, 0.10 Au g/t, 4.9 Ag g/t (0.51%Cueq)

- David: Hole CB-175: 88m @ 0.20%Cu, 0.07 Au g/t, 1.8 Ag g/t (0.27%Cueq)

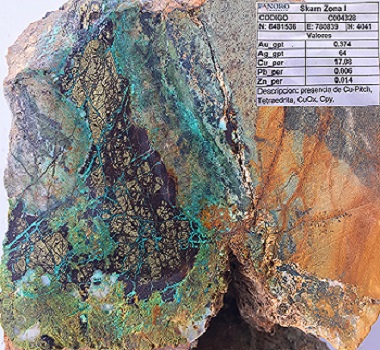

In 2018 Panoro expanded the exploration to the west, identifying five bodies with copper oxide and sulphide mineralization, covered by topsoil and vegetation. The bodies strike 20-40 degrees Northeast, dip 50 to 45 degrees to the Southeast, and cover an overall area of 1.2 km by 0.80 km at surface. The area was named the Guaclle North target, now the “NW Pit Target” which is located 500m to the west side of the PEA North Pit limit (Figure 2).

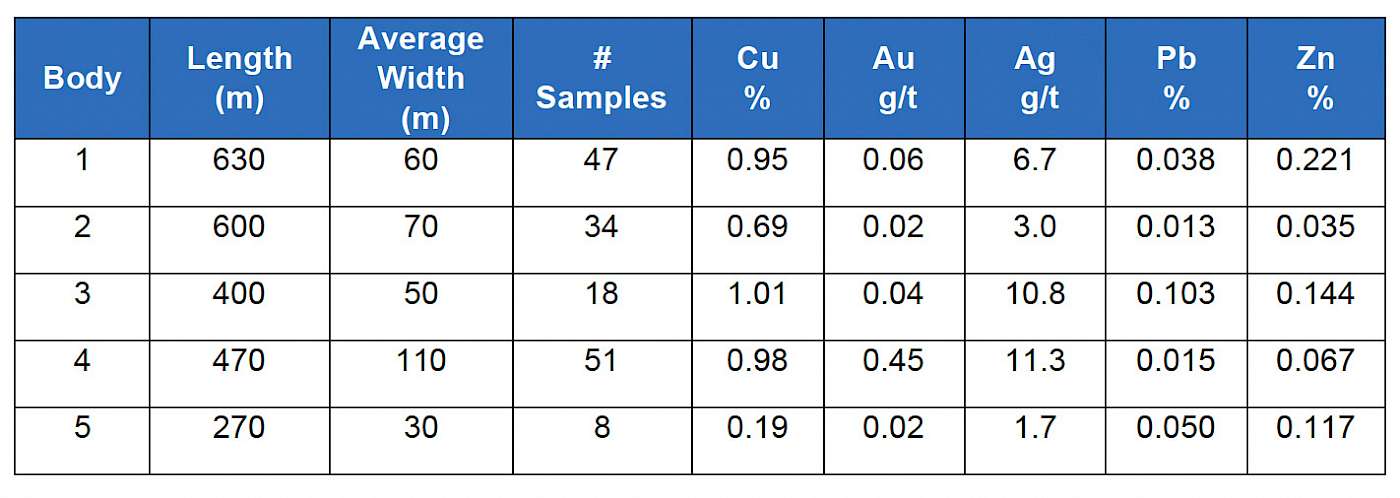

The following table shows approximate dimensions, number of rock samples, average width and grades supporting the continuity of each skarn body at surface. The results were presented in the press release of July 2nd, 2019 (see locations in Figure 1):

The mineralization follows the stratification of big blocks of limestones, over thrusted by the diorite from east to west which host the 750m corridor of Petra-David target as show in Figures 1 and 2.

The Skarn is composed of andradite type garnet, massive magnetite bodies and layers, epidote, pyroxenes, intruded by small windows of early and intermedium-stage porphyry dikes. The copper oxide mineralization is composed by malachite, brochantite, minor tenorite, and the hypogene copper mineralization by chalcopyrite, chalcocite and minor bornite. Detailed mapping was completed over 90 hectares at 1:1,000 scale and 348 rock samples were collected.

2023 DRILLING CAMPAIGN AND RESULTS

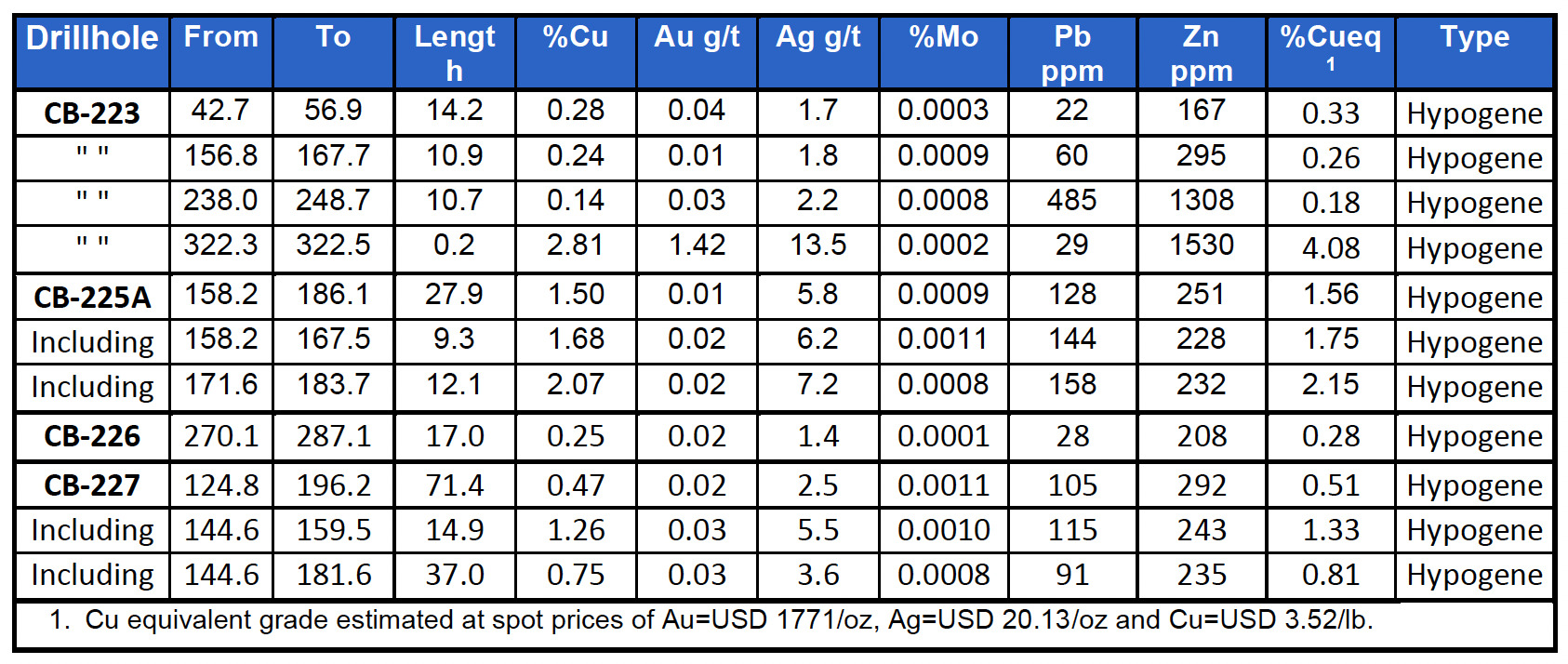

For a first step, the drillholes CB-223, 225A, 226 and 227 were directed to explore at depth the continuity of the Bodies 1 and 2, located in the foot wall of the diorite hosting the Petra-David target. The highlighted intersection results are listed in the table below (locations in Figure 1)

Drillhole CB-223 is an exploratory drill hole executed to review the north extreme of the Body 1 at depth. The hole intersected a 235m package of Skarn prograde and retrograde containing interlayering of garnets, pyroxene, epidote and massive magnetite. Inside the package were recognized until three flows of hypogene sulfides with widths varying from 10.7m to 14.2m, averaging from 0.14% Cu to 0.28% Cu, 1.71 to 2.16 g/t Ag, 0.01 to 0.04 g/t Ag (0.18 to 0.33% Cueq). This Body is open for more exploration in various directions. See Figure 1.

Drillhole CB-225A is an exploratory drill hole located 450m to the south of drillhole CB-223, directed to review the Skarn continuity below the Bodies 1 and 2. The hole intersected near surface the garnet and pyroxene skarn of Body 1 from 25.7 m to 104.2 m including some anomalies from 0.12% Cu to 0.42% Cu and 0.5 g/t Ag to 12.20 g/t Ag.

Body 2 was intersected also, from 158.2m to 186.1m (27.9m) containing copper hypogene sulfide averaging 1.50% Cu, 5.79 g/t Ag, 0.01 g/t Au (1.56 %Cueq.), including one interval of 12.1m grading 2.07% Cu, 7.2 g/t Ag, 0.02 g/t Au (2.15 % Cueq), and a second interval of 9.3m averaging 1.68% Cu, 6.17 g/t Ag, 0.02 g/t Au (1.75 %Cueq). The main composition is a semi-massive magnetite containing semi-massive and patch of chalcopyrite and minor pyrite, interlayering with massive andradite garnets and minor epidote, pyroxenes and intervals of marmolized limestone. Various intervals of primary sulfide with higher copper and silver grades into the mineralized zone were intercepted, such as:

- 1.10m of 10% Cu, 36.10 g/t Ag;

- 1.5m of 5.49% Cu, 21.10 g/t Ag;

- 1.0m of 5.3% Cu, 26.2 g/t Ag;

- 1.0m of 3.24% Cu, 12.40 g/t Ag;

- 0.20m of 12.47% Cu, 9.4 g/t Ag; and

- 0.30m of 8.65% Cu, 24 g/t Ag; including

- Au values from 0.01 g/t to 0.06 g/t, Pb from 30 to 462 ppm and Zn from 153 to >10,000 ppm. Figure 3

At 186.10m the Skarn mineralization is in contact with 190m of a late-stage porphyry of quartz monzonite composition with prograde and retrograde alteration.

Drillhole CB-226 is an exploratory drill hole targeted to explore the mineral continuity below the hole CB-225A. The marbleized limestone was intersected just below the diorite, from 27.45 m to 183.5m, containing a package of 47.8m with a mix of garnet, pyroxene and epidote skarn alterations that may correspond to Body 1. At depth 214m of the early-stage quartz monzonite porphyry stock was intersected intruded by 48m of middle-stage quartz monzonite porphyry dikes containing a low to moderate potassic alteration (orthoclase-secondary biotite-magnetite) overprinted by SCC alteration, with some intervals of quartz veinlets containing magnetite, chalcopyrite, pyrite and chlorite, reporting values from 0.10 to 0.81% Cu, 0.01 to 0.08 g/t Au, and 0.5 to 5.9 g/t Ag. This middle-stage porphyry was not intersected by the hole CB-225A and its emplacement could have displaced Body 2. Figure 3.

Drillhole CB-227 is other exploratory drill hole targeted to review the Body 2 continuity at 100m to the south of the hole CB-225A. CB-227 intersected 71.4m of hypogene copper mineralization averaging 0.47% Cu, 2.46 g/t Ag, 0.02 g/t Au (0.51%Cueq), including an interval of 37.0m grading 0.75% Cu, 3.61 g/t Ag, 0.03 g/t Au (0.81% Cueq) and another interval of 15.0m averaging 1.26% Cu, 5.49 g/t Ag, 0.03 g/t Ag (1.33 % Cueq). The mineralization and skarn alterations are the same as the intersected by drillhole CB-225A, with the massive magnetite hosting semi-massive chalcopyrite and minor pyrite. Into the mineralized zone were recognized various intervals of primary sulfide with higher copper and silver grades, such as:

- 1.50m of 2.85% Cu, 8.9 g/t Ag;

- 0.5m of 10.76% Cu, 32.3 g/t Ag;

- 0.75m of 3.0% Cu, 8.9 g/t Ag; and

- 0.45m of 2.25% Cu, 4.10 g/t Ag; including

- Au values from 0.01 to 0.14 g/t. Figure 4.

GEOLOGIC POTENTIAL IN THE NW PIT TARGET

The surface mapping and rock sampling done in 2017 permit to configure the continuity of the massive magnetite skarn on the Body 2 over 650m length in North-East direction and dipping to the East below the diorite in the located in the hanging wall. The drillhole CB-225A intersect the same body 2 at 500m below the outcropping and the CB-227 at 700m below the outcropping. The geologic potential is estimated to be between 40 to 50 million tonnes averaging 0.50% Cueq to 1.50% Cueq.

The limestone package hosting the skarn bodies still open for additional drilling exploration in different directions. To the East is open below the diorite hosting the petra-david targets; to the south in the intersection of petra target with the east-west fault controlling the mineralization in the North pit; to the west with the other three skarn bodies and the Tamburo skarn target; and to the north is open to the cateo-puente skarn target located at 1km.

The NW Pit represents a new high-grade target with high opportunity to be incorporated in the middle future, in the mine plan initiated in the North and South pits.

About Panoro

Panoro is a uniquely positioned Peru-focused copper development company. The Company is advancing its flagship Cotabambas Copper-Gold-Silver Project located in the strategically important area of southern Peru.

The Company’s objective is to complete a Prefeasibility study in 2023 with work programs commencing in Q1 2022.

At the Cotabambas Project, the Company will first focus on delineating resource growth potential and optimizing metallurgical recoveries. These objectives are expected to further enhance the project economics as part of the Prefeasibility studies during 2022 and 2023. Exploration and step-out drilling from 2017, 2018 and 2019 have already identified the potential for both oxide and sulphide resource growth.

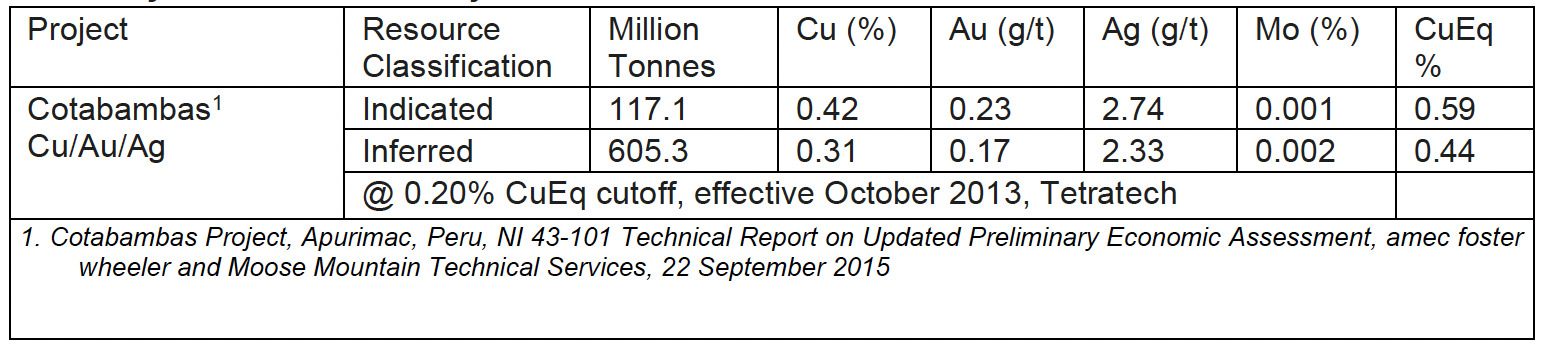

Summary of Cotabambas Project Resources 1

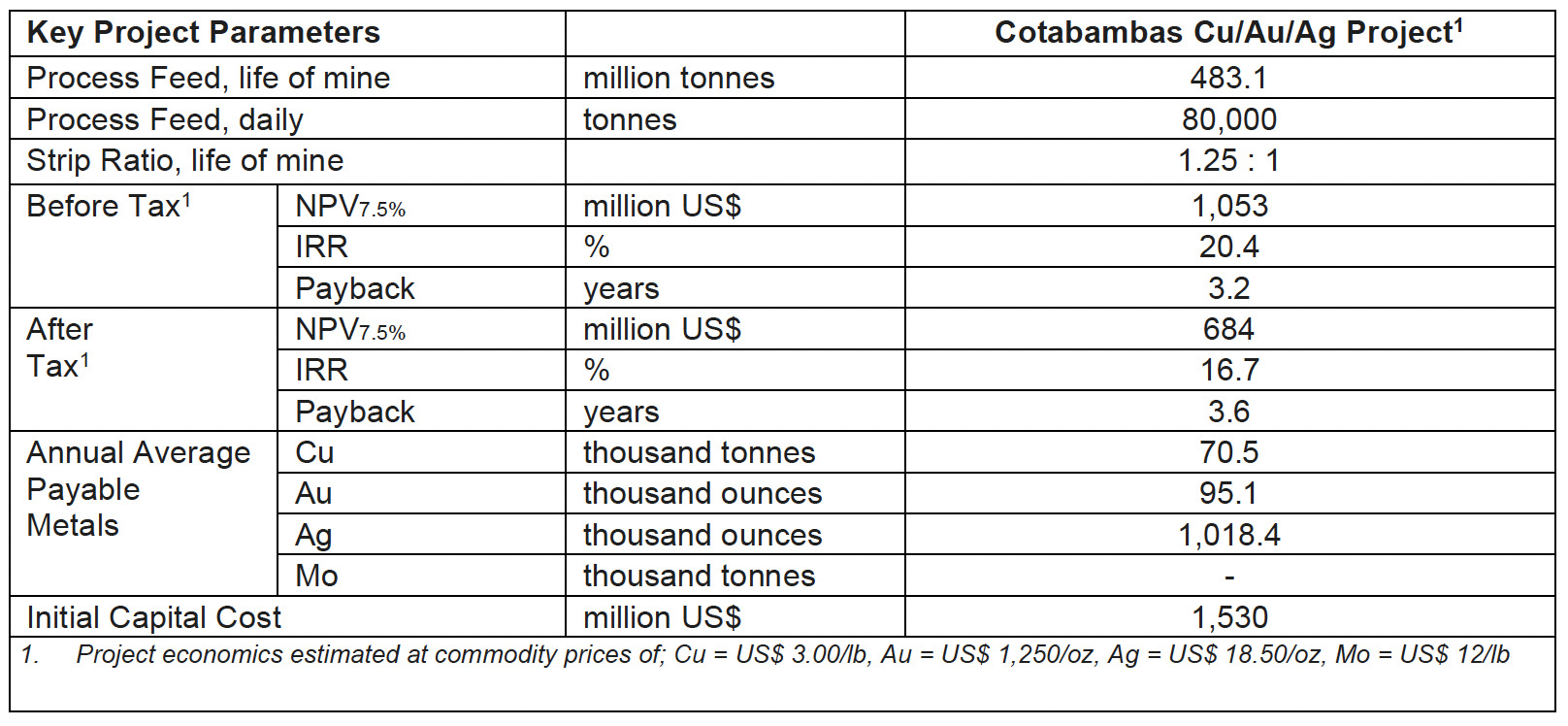

A PEA has been completed for the Cotabambas Project; the key results are summarized below:

Summary of Cotabambas Project PEA Results

PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEAs will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. M.B.A., P. Eng, P.E.

President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd. Luquman Shaheen, President & CEO | Renmark Financial Communications Inc. James McFarland, Account Manager |

CAUTION REGARDING FORWARD LOOKING STATEMENTS: Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Examples of forward-looking information and statements contained in this news release include information and statements with respect to:

- Panoro delineating growth potential at the Cotabambas Project, while optimizing project economics.

- mineral resource estimates and assumptions; and

- the PEAs, including, but not limited to, base case parameters and assumptions, forecasts of net present value, internal rate of return and payback.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. In some instances, material assumptions and factors are presented or discussed in this news release in connection with the statements or disclosure containing the forward-looking information and statements. You are cautioned that the following list of material factors and assumptions is not exhaustive. The factors and assumptions include, but are not limited to, assumptions concerning: metal prices and by-product credits; cut-off grades; short and long term power prices; processing recovery rates; mine plans and production scheduling; process and infrastructure design and implementation; accuracy of the estimation of operating and capital costs; applicable tax and royalty rates; open-pit design; accuracy of mineral reserve and resource estimates and reserve and resource modeling; reliability of sampling and assay data; representativeness of mineralization; accuracy of metallurgical test work; and amenability of upgrading and blending mineralization.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- risks relating to metal price fluctuations

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning, or reclamation expenses, proving to be inaccurate

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro’s control

- risks relating to Panoro’s or its partners’ ability to enforce legal rights under permits or licenses or risk that Panoro or its partners will become subject to litigation or arbitration that has an adverse outcome

- risks relating to Panoro’s or its partners’ projects being in Peru, including political, economic, and regulatory instability

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits

- risks relating to potential challenges to Panoro’s or its partners’ right to explore or develop projects

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances

- risks relating to Panoro’s or its partners’ operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict operations

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law

- risks relating to inadequate insurance or inability to obtain insurance

- risks relating to the fact that Panoro’s and its partners’ properties are not yet in commercial production; risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates

- risks relating to Panoro’s ability to raise funding to continue its exploration, development, and mining activities; and

- counterparty risk under Panoro’s agreements.

This list is not exhaustive of the factors that may affect the forward-looking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information. The forward-looking information contained in this news release is based on beliefs, expectations, and opinions as of the date of this news release. For the reasons set forth above, readers are cautioned not to place undue reliance on forward-looking information. Panoro does not undertake to update any forward-looking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.